About Them Taxes! (GUIDE: How to Set Policy)

•

by

•

by Jewitt

1 December, 2010, Day 1,107 of the New World – The following Report is a continuation from our previous issue, Let’s Consider Some Things. In this issue we will review the options the United States Congress has, the problems facing each issue, and give debatable material for both sides.

I ask that all major debates be redirected to the centralized public debate thread on the eUS Forum, Tax Rates, discussion…, and comments be light so not to load everyone down!

Also, it keeps everything in a single spot. The last article brought a lot of copy/pastes, and I ask that any detailed questions on mechanics or terms be asked in the thread as well. More than likely, someone else is thinking the same thing. We’re in this together, folks! Let’s get it figured.

First off, this is entirely written under the motif to get the United States people, and in retrospect their Congress, to be open to measuring any shifts that have occurred due to the changes of V2, Rising, and our current mechanical model with new raw materials and a single skilled work force with fewer finished goods to consume. There is no doubt the economy has changed, and my colleagues and myself agree that it is time to figure out where the equilibrium is. But why is the equilibrium so important to find?

All tax discussion revolves around one simple statement, and even today we see this as a primary argument but enither side can give recent and statistical backing to it: There becomes a point where a populace is taxed so much, that it harms the country more than it hurts. This is where the Laffer Curve and the concept of being on the left of the equilibrium originates. This is why the concept of the Laffer Curve and the position of the equilibirum is so vital to tax discussion.

The Populists always make this argument, and recently I have seen the “Too Damn High” (TDH) group rallied behind my good friend Joe DaSmoe carry on the same populist argument. However, unlike previous arguments the established tax scheme has little to no recent statistical backing. This means that, in my eyes personally, our tax system is defunct in need of reevaluation. I was hoping the Admin would stop playing Third World Expert with our mechanics so we could have this discussion, but this recent movement already sets a time and place that is perfect for the debate.

Once a nation has established the location of equilibrium on its economy, it can then begin to work on how far it wants to be from it. Recall from the previous article that being right on the equilibrium brings maximum government revenue without adverse effects on the short-term economy. Unfortunately, this brings about no personal savings as people are taxed to the point of bare necessity (also not very fun, and thus anti-retentative if that is a word). Luckily, once we see where the point is, it saves us a lot of headache of having to crunch multiple sources of information to where we just need to evaluate one.

Once establishing the scale of economy (generally via the RMU, which Pearlswine has done extensively to great accuracy and consistency) with respect to market supply, we can then correlate the position of equilibrium to the market value of luxury goods such as the soon to be defunct houses, higher quality weapons, tanking runs for personal glory, etc. Mix that with salary studies and real-time purchasing power and we have an estimate on the average savings of citizens with various spending habits.

Without equilibrium established, and thus a “blind tax system,” we have no idea where we stand. Hoping that we are on Slope A (meaning savings are obtained by all skill levels), we need to pull information from sales (receipts and VAT records are not kept by eRepublik…so this is impossible to do and leads to extreme deviant inaccuracies), wages, foreign market trends, and the effects of overproduction or underproduction, which ever may exist and to what degree of severity. Obviously, this “blind tax scheme” is difficult to research, manage, and also may inadvertently be overtaxing the people or underfunding the government’s true potential.

Establishing equilibrium also has another added benefit: It tells us how much more the government can take before we as consumers are left with no savings. This alone is a strong and very credible tool to be used by all parties involved; the populist emotion seeking and politico budget filling.

In our last issue we covered the Laffer Curve and its effects on the economy and individual savings (ie. “ur money”), as well as the hot topic of government revenue from taxes. Do note that this entire article and discussion centered around the debate of Government Revenue v. Individual Savings, and in it the sides differ greatly on how it should be appropriated. I am not here to make those recommendations, only the facts of the mechanics behind them.

If you can recall, I made the assessment that we should never have our tax scheme on Slope B, and we need to resolve that we are on Slope A. To do so, we must recall two simple laws of taxation with respect to the Laffer Curve:

If taxes increase and revenue increases, we are on Slope A.

If taxes increase and revenue decreases, we are on Slope B.

The problem then becomes what to do to measure where we stand on the Curve. With this, we have two options:

Assuming we’re on Slope A – We would increase taxes, and see if tax revenue increased.

Assuming we’re on Slope B – We would decrease taxes, and see if tax revenue increased.

Note that the underlining goal is to see an increase in tax revenue, not decrease. This is explained later.

But why do we not decrease taxes initially? One would think if we were on Slope A, revenue would decrease. If we were on Slope B, then revenue would increase. This is a true assessment and could establish the location of equilibrium, but there is a major problem: If we go below the equilibrium point in the process, we see a skewed uninformative result on top of adverse economic conditions without a formal tax policy being established beforehand (again, we need that equilibrium point to make such a policy!).

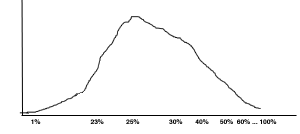

How is this true? Let’s bring that graph back.

Hypothetical Situation “Slope” A

Lets say that, for simplicity’s sake, our current taxes at 23% are exactly where that red dot marked “Point A” is. Now let’s raise taxes a figurative amount, say 7%. Now we have a 30% income tax scheme. As some may recall from the previous article, this is where during August of last year we resolved the Laffer Curve took full effect (somewhere between 25% and 30

😵and we would now reside on Slope B.

However, it will not bring us to Point B (may bring us to Slope B, though), as many of you may recall from the previous article that we are gaining maximum revenue at or around 27% (Or so we think) and that by the time we hit 100% taxation the curve has become sloped heavily on the A side and lightly on the B side (as to get to 100% takes a lot more time to cover than to 0% from equilibrium).

(Note that this is from personal research, explained below)

As you can see from this poorly made attempt at a slope while sitting in my World Civ. class, that the slope is not as perfect in practice as it is in theory. Therefore a tax increase will bring us the least functional harm to individual savings with respect to government revenue as Slope B is not as radical as Slope A. Citizens for about a week (it only takes seven days for a good tax tracking measure) will be breaking even, what the Populists seemingly are claiming they are making now, and the government takes a slight hit for over-guessing.

Hypothetical Situation “Slope” B

Now again, recall the above graph under the previous example. By decreasing taxes, we must be under the assumption that we already are on Slope B. That is not true, since as recently as just a few months ago we rose from 20% to 22% and then 23% income and noticed a significant increase in government revenue. By decreasing taxes first, without breaking the Curve’s equilibrium to know our revenue to savings limit, we are going down a steep mountainside into radical fiscal changes. It can be assumed empirically that we are currently on Slope A.

Therefore, to increase taxes (an assumption left to if we are on Slope A) is to create a more controlled and structured procedure to tax scheme establishment via finding equilibrium. Not catching on? It’s easier and smoother for wages and the economy to regulate itself to allow more savings from nothing, than to put more savings on top of existing funds. People tend to splurge, such as in battles and purchasing higher quality items more regularly. If they splurge more harshly (larger individual savings) it will cause a shift in the supply to demand functions of the economy and have adverse effects on all aspects of socioeconomic conditions. It is best to have a large influx of demand on an overproduced market (little to no savings as proposed via tax icnrease) than a large influx of demand on a stabilized market (current scheme with fair savings amounts).

Also, as we can see on the graph above, that if we decrease we will see a more dramatic and pragmatic shift in revenue and savings alike. This is where it would cause shifts in many parts of the country – including, but not limited to, monetary market, foreign trade, wages, and cost of goods. Not to mention supply of such goods would have to shift entirely from an increase in demand and static supply pool.

Now that I have presented that information on how to measure equilibrium, I would like to further explain why lowering taxes first is not a good idea with respect to measuring equilibrium. First of all, I am an educator by study and profession and speak by the policy of letting your students (oh yes boys and girls, this is an Econ 101 lesson!) know your biases.

I am fully convinced that the income tax should be lowered below the 20% line maximize individual savings without harming adversely government revenue, but I am making this statement without any empirical data. I hate to do it, and this is why I am pushing for the measure of equilibrium. I want to see numerical data that proves where it is to strengthen my own argument. Like any weapon, it is just as effective is fired from one side or the other. Keep that in mind, I am biased in covering these procedures exclusively over other detailed terms.

As you can recall from my hand-made and quite poorly illustrated rendition of a graph, the actual Laffer Curve is more or less a Laffer rollercoaster. We have that slow climb to the top (Slope

😎and that throat-grabbing drop (Slope A). This data is the compilation of my own personal research since December of 2008 – when I first began to research, plot, and study the eRepublik economic model. A lot has changed, and a lot has stayed the same, and this graph is my attempt to convey a simple message from all my studies: Slope A in eRepublik is always steeper than Slope B. My strongest argument, which I would be glad to bring this over to the eUS Forum thread linked at the topic of this issue, is that Slope B cannot be as steep as or steeper than Slope A due to the fact that taxation can never reach higher than 50% income and 99% sales, effectively 100% taxation is impossible.

Now, back to the topic of the effects of lowering taxes while on Slope A. I will list in just slight detail the effects with a slight rationale as to what brought me to the conclusion, as well as any evidence I may present.

Straining a static production base with increased demand

Our productivity is relatively static short term, as it takes weeks to months to rise in skill levels after the initial month of a worker’s life. It slowly rises, but for all intensive purposes for short term (and that is what this entire measure will cover) our productivity is flat and even. Therefore, by increasing demand with renewed savings, we cause a rise in market prices, a lowering of its supply, and potentially (though not assured) wage increase which leads to inflation of the USD (weakening purchasing power of the consumer!).

Harming of domestic business, favoring importers

Doesn’t this seem counterproductive to most populist movements? By shifting our tax policy to allow for larger demand without considering our supply capabilities, we do exactly what the straining of demand above implied. This will harm U.S. exporters and help importers from overseas by being able to dump any excess they have on our newly expensive markets. Without the slow and temperate movements it could lead to short-term disaster domestically for both consumers and corporations.

Instability in Government Revenue

Our Monetary Market is far too large for the Congressional Budget Office to soak up excess circulating USD quick enough, and with more offers brought by more importers, speculators, or citizens trying to cash out before a potential inflation-led collapse of their USD’s worth that Budget Office will be unable to obtain GOLD from its USD tax revenue. This, in turn, means a gross majority of government operations (especially battle security and specific military funding) will come to a grinding halt.

Instability in the Work Environment

As I mentioned, this inadvertently would cause a shift in wages due to an increase in demand without a similar increase in supply. Which direction it goes depends on how well the decrease in taxation is done. This is delving more into a future topic, the effects of establishing a tax scheme very much below the equilibrium, but there is a potential for so much additional USD circulation (rea

😛inflationary trends) that citizens end up having less purchasing power abroad, businesses may struggle terribly to export their goods, and despite the fact that a citizen making (hypothetical numbers) 30 USD is now making 80 USD, they’re actually making less when converted to GOLD.

We need to find where the equilibrium point of the Laffer Curve is so we can actually have facts when debating something factual like taxes.

Maybe we should also see about causing as little damage to the economy as possible to workers and businesses while doing these “experiments” to find equilibrium. Instead of being selfish and self-promoting ones own agenda while admitting equilibrium location is important, because that would be ridiculous and irrational, amirite?

Lowering taxes dramatically at once is as dangerous as raising taxes dramatically (trust me, I’ve been there and seen it!). We should be methodic and slow in our moves so as not to cause severe damage to our economy and economic base (citizens and companies).

That’s all folks.

Written by,

-Jewitt

Comments

First DENIED

Second

KETIGAXXX. Nice article.

Well done

Just because I feel like I did not make it clear enough, that little graph I made to show the irregularities between the slopes is *not factual* and not to be used for analysis. It is just proving a point that Point A on the original graph does not equal Point B.

As you were.

Fun fact: typing the equal sign, forward slash, equal sign makes an equal sign. Odd...

Lame

those are some interesting graphic headers...... 😛

Again the whole idea behind the Laffer curve is milk as much money as possible from the base before the try to avoid paying the tax.

I think we should figure out what we need for basic government operations and set the tax rates accordingly.

ⓋⓄⓉⒺ

How would getting (making) companies pay income tax rather than pulling gold/USD out through the monetary market effect this data? In every article I have read not once has anyone addressed this issues.

Who said Revenue?

Voted

"Without equilibrium established, and thus a “blind tax system,” we have no idea where we stand. Hoping that we are on Slope A"

Thank you for a candid assessment of Taxation Policy.

Comment 1) There are three independent Laffer Curves... of which Current Tax "Policy" (Or, Lack of Same) is only harnessing 1... Ironic.

Comment 2) Gov't Does NOT know best. Had we invested in a national food reserve when times were good instead of embarking on the "for the Lulz" Mission of PTO'ing russia we (the eUS) would have at the very least the equivalent of 100,000 Q1 bread for our citizenry to utilize to further national efforts. (that's just the most recent glaring example)

Comment 3) What is good for the domestic economy is good for the country. Popularists can and should only be ignored @ your own peril. It is my hope that you will support the 20% income tax rate we advocate.

@Joe "I think we should figure out what we need for basic government operations and set the tax rates accordingly." I completely and emphatically agree. We must re-evaluate ALL levels of gov't expenditure in order to foster true economic planning.

Epic.

Good luck on getting the government to actually tell you what they spend and what they spend it on...seems that information is top secret....

'Comment 2) Gov't Does NOT know best. Had we invested in a national food reserve when times were good instead of embarking on the "for the Lulz" Mission of PTO'ing russia we (the eUS) would have at the very least the equivalent of 100,000 Q1 bread for our citizenry to utilize to further national efforts. (that's just the most recent glaring example)'

Amen....

We could NOT do PTOs. That works. We still need ATO operations though... So ATO and Military funding coupled together, minus ALL our programs(NO meals on wheels for citizens who kindly try to fight for America and no arm america).... we could lower taxes to 20% with that.

However, you get about $27 USD a day. With current taxes, that's $20.79 a day. Or $623.70 a month. With 20%, it's $21.60 a day. Or $648 a month. $24.30 a month more. $8(10 health per attack) for one fight in the military module. Therefore, you get three extra kills AT MAXIMUM PER MONTHS. That is assuming that you one hit kill WITHOUT A WEAPON. The actual benefit for you by cutting income tax to 20% is three extra fights per TWO months. And of course, as I regurgitate over and over, you'd be better off without the cut by using programs provided by the gov't than you'd be with it.

I say we keep it based off the Laffer curve. Gov't COULD use to be more efficient and slightly less spontaneous in its spending. We need to continue building hospitals or defense systems on our coasts with any money left over from funding programs.

As for the waste of money on the PTO of Russia, that's the first *huge* mistake they made in quite a while. We usually(understatement) don't do PTOs.

I dont care about taxes

The problem is we're talking about two totally separate things, and I'd appreciate it if you "anti-govt" guys recognized this. Then again, some of you have failed to do so in the past. This is setting taxation policy with numerical limitations being known. The idea is to *not get close to equilibrium.* Yet somehow all of you say it's a way to milk the people even more. Idiocy or ignorance of being able to read literal words, either or.

Most of the arguments heard are around spending habits (ie. budget) and not taxation policy - totally different argument. The simple mentality of "If we decrease spending by X amount, we should decrease taxes by X amount!" is also seen a whole lot. Yet they totally ignore the other mechanical limitations which will inadvertently harm the nation's economy, citizens, and corporations even more than if we kept this apparently oppressive tax scheme. Please, re-read (or rather, read for the first time to some of you) the entirety of the article and then comment. If you don't understand something, the forums and my inbox are always welcome to inquiries.

in the event of inflation of the USD and possible invasion of foriegn goods couldn't American Business be protected by import tax?

Not saying I want to see that scenario at all.... but...

I will respect your wishes and keep this short

you mentioned straining a static production base with increased demand...

couldn't it be argued that perhaps this would be short term as well, and with any changes in tax that there would always be some sort of fluxuation in any direction in regards to supply and demand? Too much supply is as bad as too much demand, one leads to unemployment and the other to inflation. I believe the technical term is Demand-Pull Inflation for the later.

You have to admit, the free market has never been very predictable, infact it is down right unwieldy

My point is, no matter what direction is taken, even in these test runs, there is the potential for harm regardless of precaution is there not?

We should hold off on this debate until the new economy kicks in and finds some stability. Why do all the number crunching, only to have the econ module change in a few days?

never hurts to speculate

Jewitt, thanks for publishing this outside the eUS forum. I don't visit there, so please allow me 3 comments here:

1 - Income taxes were initially set high because they are the most reliable and measurable source of revenue. (All two-clickers work, and this taxes that click.)

2 - The One Eye theory is entirely geared toward maximizing damage on the battlefield -- not for economic or revenue 'efficiency.' One Eye knew govt would spend a greater percentage on warfare than individuals, and so revenue was maximized from its most reliable source.

3 - The RL Laffer Curve was a PR stunt used to sell the Reagan tax cuts. Proponents claimed the cuts would spur the economy, ultimately growing revenue. It did not work that way. It created deficits.

Great stuff, just wish some of ya'll would post on the forums. 😛

Any shift in policy will always cause a shift, and the free hand is a joke. This is where I will admit my RL biases: I am a fan of methodology and steady, controlled, economic shifts. Or as much as possible. One Eye shared this idea, and although he focused on military damage it directly correlates to government revenue without hampering the nation's economy.

The Laffer Curve was totally a PR stunt, but I have seen it at work in the eRep module and we have proven its existence on multiple occasions. I am far from a fan of Reagan and would be the first to criticize his supply side BS, but the Curve exists nonetheless.

I don't like the forums as much as the next guy that doesn't like the forums.

But this was a damn good article.

Jewitt, I was wondering what your feelings are on the missions that admin has implemented, id est, what effects have they on the economy. Some of the missions require a citizen to purchase far more than they otherwise would.