Let's Consider Some Things (About Them Taxes!)

•

by

•

by Jewitt

29 November, 2010, Day 1,105 of the New World - The following Report is a special return to normalcy, discussing the very first topic that this paper ever delved into: Taxation and fiscal policy.

There has been ongoing debate about taxes. Are they too high? Are they too low? Are they just right? Presented in this article is a brief overview of my own personal economic theory, which inter-laps with the aging One Eye Thought and consideration of our changing nation's economy.

Without further introduction, here is the article. Note that this was originally posted on the eUS Forums, under the thread, "Tax Rates," and I encourage all interested to delve into the debate.

In this post I would like to explain the Laffer Curve and what it has to do with our tax scheme. I will ignore the VAT v. Income debate, as it takes a truly idiotic conservative or an intelligent Libertarian (or a little of both) to endorse such a system in-game and, if I dare say it, IRL. I will also cover at the bottom of this post the issue of savings and its effects on the eRepublik economy.

If you oppose or support a tax system and do not even grasp the basic concepts contained in this post, you are harming the policy you are advocating by making its supporters look like complete intellectually deficient Britons. Read, learn, become a better weapon for your agenda.

The Laffer Curve is named after the guy that came up with it, Laffer. Don't ask for his first name, I can't remember and Google can tell you.

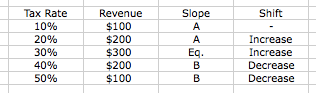

Now isn't that pretty? First, let's get some things out of your mind. First of all, that graph is not saying taxes at 50% will bring about maximum revenue. The side of the curve below "Maximum Revenue" labeled "Point A" will be referred to as Slope A. In this fashion we will name the side with "Point B" Slope B.

So, what are you looking at? Let's explain it under a few assumptions. This in no way means that these numbers are factual. Let's say that at 1% and 100% taxation, we make only 1 USD. Let's begin by saying we have income tax at 10%. We make 100 USD. Now let's go to 20%. We now make 200 USD. As we see on Slope A, revenue increases as taxes increase. Now let's say the equilibrium is 30% where we make 300 USD. Let's make taxes 40%. At 40%, we now make 200 USD. This is due to many reasons, such as citizens having less money to purchase goods with. Increase taxes to 50% and we now make 100 USD. Now we are losing even more money because consumption is down. This inadvertently has probably caused prices to drop, profits from companies to crumble, and the general purchasing power of the citizen to fall. So this leads us to the assumption that on Slope B, as taxes increase, revenue decreases.

Here's a graph showing this information:

Photo courtesy of myself.

In this economy, we also notice something. It's not perfect. We began making our revenue at 10%, but lost it after 50%. So in theory, this economy could be making quite a few losses at 70% (10% from 60

😵, whereas at 1% (9% from 10

😵the economy is making 1 USD. This also helps show that the Laffer Curve does not give clear answers, and we need to experiment and show empirical data to back up all moves.

Now, let's fast-forward to the eUS theory. At one point in time, I believe it was Cromstar or ProggyPop that called it the "One Eye School of Economics," which insisted that income tax was a far better and more efficient way to budget and plan an economy than VAT. Following that was another School of Economics which fought Import Taxation, but for simplicity sake we like to throw it in with One Eye since he really was the genius of income tax persuasion and anti-Imports. That is also a topic for another day.

Under the One Eye School one looks at the efficiency. That is, all those who follow it look for where the equilibrium point on the Curve is and we try to obtain it. After some albeit imperfect conditions (we rarely ever are in a stable economy to begin with, especially now with Admin intervention almost weekly) we determined that the equilibrium existed somewhere between 25% and 30% income. We found this out while I was actually Secretary of the Treasury during our invasion, when I recommended we temporarily boost income taxes to 30% to grab as much USD as possible from two clickers in regions we were about to lose.

I was mistaken, and forgot this basic economic principle. For the sake of simplicity, let's say that at our previous level of 20%, we made 50,000 USD a day. When we boosted our taxes to 30%, we actually made 47,000 USD a day. Mind you, we only lost a few states that had alive populations below twenty each. This lead myself and the entirety of the Economic Council (now relatively defunct...wish someone would revive it) to look into the possibility of a Laffer Curve, as in real-life the Laffer Curve in the United States is estimated around 60% of a household income as of 2006 (yes, America, you're undertaxed and over-saving/spending like Hell). Our error was we thought, absent-minded, eRepublik was similar to real-life.

It only took a week of data gathering (seven days proved to be enough to realize we were making far less than before) for my recommendation for a 30% income tax to be removed, and I personally asked then-President Harrison Richardson to ask Congress to lower them to 25%. We were conducting our own little experiment in the Economic Council, and the United States was the mouse.

Two weeks passed under the 25% income, and we netted around 59,000 USD a week (again, for simplicity's sake...I cannot recall the numbers and am too lazy to look at the Congressional records). So this proved that we were still on Slope A at 25% income, meaning we could either increase or keep the taxes as were and still be on Slope A.

Fast-forward to today, and our taxes were dropped to 20%, then up to 25% again, then back to 21%, and now at 23%. Each time we have made an increase, we have noticed revenue gains. Therefore it is numerically proven that the 23% income tax rate is on Slope A of the Laffer Curve.

The next problem is savings. Now, I did say problem. It is nice to have a bunch of savings and be able to blow it all on that big massive battle. But, when is that massive battle going to happen? Will that big massive battle be as important to you as it is to me? What if I decide a battle in London is worth "going all in," while you think it's not even worth buying a weapon for? What if ten days later you see this amazing battle that will "change the war forever!"? I already spent mine on another battle, so I am useless. You're left alone.

Savings is individualist. It courts the individual and is consumed irregularly. Efficiency and One Eye School wise, savings is more of an impractical harm on the economy than it is a savior. It also creates an imbalance in forecasting revenue (end up with extra USD to convert than planned), battle damage (overspend tax payer's dollars on wasted damage), and many other ailments which make us inefficient. The savings are best spent, again efficiency wise, in the U.S. Government.

Unlike real-life where the Government is absolutely corrupted and barely transparent, the eRepublik United States Government is 100% transparent (after a few months...nothing like 8 to 16 years like the RL Gov't), 100% accountable, and the fact that a poor worker can post an article and have it skyrocket to the Top 5 media of the entire country is unrealistic, and a welcome whistle-blower in some situations. In this, I have my full faith in the United States Government to appropriate my tax dollars properly. Why?

Whenever an individual spends all of their savings on a battle, either to grab a battle hero medal or to contribute to the overall glory of the nation, that is money spent only for retention and not efficiency. If they have been here long enough to accumulate savings, they have already been retained. Retention is no longer as major of an issue. Especially if they ranked up their citizen on their own dime and then quit after spending all their savings.

This is where another School of Economic Thought comes into play. To be honest and not so conceded sounding, a poll was conducted a while back where there was the "One Eye School" and the "Jewitt School," and the clear difference was the view of the individual on the economy. The One Eye School viewed the individual much like a socialistic program of Marxian theory - A well oiled gear in the perfect machine. By having all the gears perfectly formed, oiled, and trained the machine would be unstoppable.

The Jewitt School, named probably because this is the only place where One Eye and I disagreed on, was based entirely on making the game fun for the individual while still focusing on national efficiency, a mediation between One Eye Thought and the occasional Populist/libertarian thought. It challenged the idea that eRepublik was 100% battles, and instead broke it down into 50% battles, 20% social, and 30% economy. That 30% economy is the focus of why I fought for limited savings. It can be debated that the eRepublik of today is much more battle oriented than it was when these debates happened, in which case both social and economy would take a hit and battles would be increased in our daily consumption options (not needs, since in all honesty there's nothing to buy for pleasure unless it helps on the battle field in some way).

Primarily, the idea is to not reach equilibrium. At equilibrium, the tax payers make no savings at all with government revenue at its peak. By being slightly below equilibrium, individuals are able to create a small and meager form of savings. These savings are to be geared towards affording a house (if it is more efficient, mind you, than the equivalent consumable food) and fighting while maintaining 100% working efficiency, ie. >99 Wellness. These meager savings also could be used to purchase other goodies, such as extra fights for a battle hero medal or even buying one's own company.

By allowing citizens to obtain savings and give them a goal to spend for, this alone would be a retention tool that they previously had not had without savings. This is especially important for non-military and non-government citizens whom do not receive daily food/weapon funding or medal gold from election achievements.

With these two sections out of the way, the Laffer Curve and its relation to the One Eye School and individual savings and the Jewitt School's view of them, I hope everyone can now make informed and contributory arguments for and against policies.

tl;dr - Read the wiki article on the Laffer curve, One Eye said efficiency rocks and individual savings are not efficient, and Jewitt said some savings are necessary for retention but overall everyone should gear towards national efficiency. But too much savings is too much of a lag on our overall battle efficiency.

Written by,

-Jewitt

Comments

First DENIED

Second sort of Denied

3rd denied

Jewitt is sexy.

Art Laffer would be proud.

Too much actual information, must not be true ; )

Broted.

A 23% tax is way to high taxes should be decreased to 15 % and no more.

Delicious food for thought. Thanks Jewitt.

Loved the tl:dr table

@Deejster: Thanks for your expert opinion, 4-day-old guy.

I was here for a 1 year and half but i left from japan hey I am just trying to push for a tax cut thats all

I assume this article is a precursor to the tax hike Congress is considering. That's right they are now going to "experiment" with the laffer curve and see just how much tax you can stand. Congress has begun to talk of raising your taxes to 28%.

The basic theory of the laffer curve is to get as much money out of the base population before they begin to try and circumvent the tax (donations, MM transfers) or avoid it all together(leave the country)

Good article Jewitt, you are a smart guy and I respect you. I stand on the other side of this argument though.

I don't believe we should search for the point that maximizes government revenue, I believe we should search for the point that provides us enough revenue for the basic necessities of Government (yes I said basic), and the individual player should be able to use the rest of their money as they see fit.

lol

The table says "tl/dr".

The theory is nice to know, but with all of the different variables involved in determining the curve, how do we know that the curve hasn't changed?

Are there actual numbers someplace? I get the whole sensitive nature of the data, so I'm not going off on a transparency tirade.

My point being that in my RL experience (I've held elected offices) with making budgets and taxation, you take the number that you need to bring in with revenue and work backwards to determine your tax rate.

I get the impression that we just threw figurative darts at this curve and found a successful location. What is to say that the curve, in our case, is even a curve?

Jewitt is the Pruitt to Ford.

...idk what that means, but I love him.

Its nice to see logic in a tax debate. Most of the articles on it lately have been rather lacking in it.

I assume you are referring to Tango's article SweetBags. lol

If the congress does actually UP the taxes to 28% then I'm sure there will be a growing interest in working under the table and/or how to avoid taxes on businesses.

At least though I did learn more about a principal of economics I'd only heard mentioned in vague terms.

Nice to see an intelligent and insightful article on what the national policy should be again.

taxes don't necessarily have to be at the equalibrium point. that would be the most benefit to the government profit wise, but not the workers. I believe taxes can be lowered a bit to, as Jewitt explained, allow workers to save for houses, which aint cheap, moving tickets, guns and such. That extra 9.50 a week can go a long way

why is this coming up now? Its been high for a while, actually a very long time. Im not a fan of tax but I understand it needs to be where it is.

I understand why people want taxes lower more money in their pocket is nice. but on the other hand I dont get why people are complaining now. If people want to save for a house and are getting paid a normal wage the difference in 3% shouldnt have that much of an impact on it. Get some HW medals or SS medals to cover it thats where the most money comes at once

I know I am may be only a 5 day old player but I did play before and if we can at least get the taxes down to 20%. I mean 23% is a high tax for all eAmericans, the basic principal is if a citizen has more money in his pocket he will spend more. On my limited paycheck I can only buy food I just believe we need to make our voice loud enough for people in congress to listen.

@Leplatt: Because someone is running for office and populism works.

@deejster: if you had more money you would spend it on what? more food that you would eat just as quickly. more money in your pocket doesnt help much if all their is to buy is food.

You say you played this before then you should know its hard to start, get into the game and you get paid more. at 5 days old you arent going to see a big increase in pay from a 3% tax cut.

@kfitzy Yes I know I will not I also played when hospitals were more relevant. Now I can fight and only recover me health by buying food and I want to start buying weapons and saving up USD for elections.

@Deejster: Weapons should only be bought after you are certain that you can max your food fights food is more cost effective than buying a weapon. It got really expensive to fight to the max capable and a 3% tax cut isnt going to help that much

Also the government hands out guns on important battles

I wouldn't like to see taxes come up at all really, and I would like to see them go down to 20%.

That said, Jewitt definitely knows his stuff better than most people who think they know economic things.

Good stuff, Jewitt.

Savings are totally worthless. Thats why erep doesn't have any companies. No one has ever been able to afford one.

lol

Once again, Jewitt exposes the statist-fascist nature of eUSA thinking by considering individual savings to be a dead loss to the nation's economy. The Laffer "equilibrium" becomes the point at which it is counterproductive to soak the taxpayer, in true supply side economics, there is a long term positive effect in terms of growth and revenue as savings get used to generate new businesses and grow the economy. What Jewitt is saying here is that economic growth is not possible, so you might as well be a Keynesian. But Keynesianism only works if you give the benefits of the government, not to the elite for tanking, but to the working class that will spend money right away and recycle money into the economy. The beauty of following the Eight Imperatives of Inactivity is that is counteracts these horrid government policies that long forgot about the common good, and withholds support for a state that doesn't care about you, and acts against your interests. Just keep saving lots of money. Bring both the government and the economy to its knees. Drive out the elite using their own tactics.

It's Arthur Lafer ; )

nice work...

Nice, very nice. Its been eons since the tax debate has come up, but when it does it tends to be a big deal. I have to agree with one part of samuel's argument. The eUS economy has started to grow for the first time in almost 5 months. We need the most favorable job market possible here so businesses will open up. Wages have been inflating at an ever increasing rate over the past few weeks as new players join and no new businesses are opening up.

Finally an article with facts and numbers instead of 'feelings'. Sadly, the side that wants lower taxes can't come up with facts.

inb4/after people herp and derp.

I'm too lazy to read this. I'm gonna vote however Pearlswine wants.

> Jewitt is arguing for no savings.

Did you even read the section titled "INDIVIDUAL SAVINGS" and the theories presented, and what I admitted my personal beliefs were? Honestly people, read before you talk. You sound like a dirty New Jersey-ian whenever you don't.

Noticable events along the curve are not always generated by variables directly associated with the curve.

Taxes will fall, those whom resist this basic fact will most likely fall from the "grace" of Elitehood, along with our tax rate.

I thought it sounded like you are arguing for limited savings, at least that is the way it came out

Vincent Nolan, "limited" is subjective and that's sort of what I was trying to imply. We should always give our citizens enough savings to be able to afford some nice pleasantries that I do not get (as a military commune worker) - such as a house, the occasional tanking funds, or even enough to expand/buy companies. I have seen plenty of entrepreneurs rise up since the 20% income tax over a year and a half ago, and few if any buy gold packs. So imo savings amounts then were good.

I have a feeling we need to reevaluate our position on the curve. If we are too close to equilibrium, or on Slope B, my whole theory says that as a citizenry we are becoming *too efficient,* if I dare say it, and need to loosen the fiscal restrictions on our tax payers.

in other words, lower taxes based on the results of where you believe, which I imagine is above Slope A and possible pretty darn close to the equilibrium, 23% is on the curve

@Vincent Nolan

Irrespective of your positioning upon the slope, the curve itself allows for taxation to be tweaked/ leveraged... it cannot and will not be the governing basis for tax policy. Taxes are no longer "for the Lulz"; it is serious bizniss.

Regarding efficiency, Amount of tax revenue collected or the theories governing have *NOTHING* to do with how efficiently you may or may not be allocating the eUnion's Coffer. Think of it in terms of a water wheel... how much water you collect from the Citizenry has no impact upon where Congress allocates the water once its exited the wheel.

Nice to see Jewitt writing again

80% of noobs leave because they think eRep is boring. Giving money back wouldn't help. In fact, it would hurt. If it takes longer to reach an important place in the market, create multiple companies, and spread across the world, than GOOD. The longer the tame it takes to "win" the better. What will you spend it on anyway? You can already afford houses and food aplenty and still achieve what I just mentioned. Where is the problem?

If you DO want to fight(awesome!) then join the military. It only takes about 15 extra minutes of your day and you get MUCH more food than you could afford by cutting taxes to 15%. And speaking of people who join one day and quit the next(or after a week), 23% helps more to reduce the negative effects caused by them than 15% would. That's about all there is that I have to say.

@Joe DaSmoe

As I have said before, I am conservative IRL. Like Tea Party. And let me say..., no. You are a one-in-fifty player, my good sir. You willingly fight for America with your own funds. Let me ask you this, why don't you see, over the course of an entire battle(24 hours minimum) more than the same 200 players(EDEN and Phoenix sides)? Not all two-clickers do what you do.

We leave taxes at 23% for your benefit and ours. As for "Corruption! You just want money, you goverment ***", this:

1)I ain't in politics.

2)WHAT do we have to gain from extorting our OWN country in this GAME? If you want to find a game like this, but more realistic in terms of economics and politics, find another one.

3)Even if we were like that, WHAT would we spend it on?

Russian Prostitutes?

Sombreros for Operation Purple Taco?

Medicinal (wink wink) Mary Jane?

Or maybe you just pile it all in a dark dank room in some far away dungeon and roll around in it every once in a while......

I'd do that

Awesome.

lolz. Close. (Actually, it's defense systems in Florida; take a look at it.)

"By allowing citizens to obtain savings and give them a goal to spend for, this alone would be a retention tool that they previously had not had without savings. This is especially important for non-military and non-government citizens whom do not receive daily food/weapon funding or medal gold from election achievements."

AMEN! Thank you Jewitt for recognizing that this segment of the population not only exists but, has a deserving right of place. I believe non-military, non-government citizens are a huge resource just waiting to be tapped. Kudos!