LAZY CODING: How Plato cheats small countries

•

by

•

by Releasethe Krakken

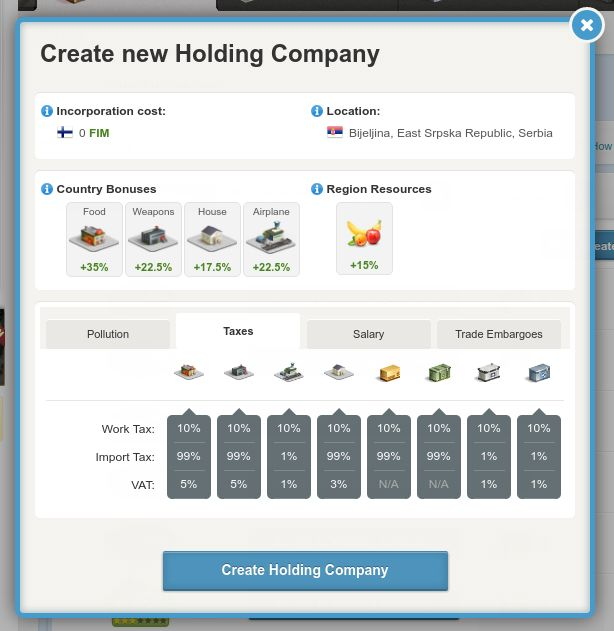

When Plato introduces new economic changes [ARTICLE HERE]

He was talking specifically (just to stop confusion) about holding companies. Various aspects introduced by their addition to the game.

Amongst one

Taxation

Work as Manager Income Tax will be shared between the Country where the Holding is based and the Country of the manager’s citizenship, as follows:

Paid tax: 80%(Holding Country work tax) + 20%(Citizenship work tax). As a reminder, for Work as Manager, the Income Tax is paid based on a Country’s average salary and Work Tax law.

Example: Citizen works as manager in a Holding located in Country A and has citizenship in Country B. He will pay 80% of country A’s Income Tax (to Country A) and 20% of Country B’s Income Tax (to Country B ).

Wait what?

Here is an actual example from my holding company in Idaho.

As you can see the USA 's work tax is at 1% and Irelands work tax is at 1%.

Their everage salary is 168.18 = 1.6818 per wam click

and ours 183. 16 = 1.836 wam tax per click

So for 1 wam click BY ME the USA gets 1.34 and Ireland gets 0.36 added it gives us 1.70 and as I rounded you can see the correct calculation was made by Plato.

Now for all wam clicks this formula will hold and we must get 36 cents per factory.

Lets see

Idaho

That gives me 184 x 1.34 for the USA = 246.56

and 184 x 0.36 for Ireland = 66.24 for Ireland

is correct

Now lets continue

Alaska Gold

145 X 1.34 = 194

145 X 0.36 = 52

= 246.20 [REMEMBER ROUNDED SO MY FIGURES WILL BE SLIGHTLY LESS THAN THE ACTUAL AMOUNT]

KENTUCKY

91 X 1.34 = 121.94

91 X 0.36 = 32.76

= 154.7

WASHINGTON

USA : 76 X 1.34 = 101.84

IRELAND = 76 X 0.36 = 27.36

= 129.20

Azorez,PORTUGAL

IRELAND = 17.28

Lets count all

IDAHO : 66.24

ALASKA : 52

KENTUCKY : 32.76

WASHINGTON : 27.36

PORTUGAL : 17.28

195.64 =

FOR THE USA I PAY

IDAHO : 246.56

ALASKA : 194

KENTUCKY : 121.94

WASHINGTON : 101.84

664.34

now lets look at we actually got

Remember I did work every day and upgraded on Sunday I think. But we can see although I worked fully each day.

The Work Taxes of Ireland is below what was deducted for Ireland.

My guess is somewhere there was just a lazy programmer that did not do his job properly. Im not even certain where the rest of the money goes.

As how can one explain it away?

DOES FYROM / SPAIN GET THE MONEY?

https://www.erepublik.com/en/main/latest-updates/0/75

This is an update pre Holding Companies. Remember one thing the tax you get from foreign companies is not determined by the amount of regions you own.

So 0/6 still equals 0.36 as would 6/6 equal 0.36.And that is not what the update say.

Comments

I think that a part of the taxes go to Fyrom because it has some Ireland's region

yep that may explain it. but the usa is not occupied by fyrom. so its incorrect to give that money to fyrom as they do not own that region.

also the rules was clear country of citizen not country that occupy country of citizen. its a bug money should go to ireland directly.

Try to look here.

https://forum.erepublik.com/index.php?/topic/1778-taxation-of-occupied-regions/

From this I understand that before it is calculated the total incame of Ireland, and then a part of this incame go to Fyrom, and the remaining part remain in Ireland

yeah remember our companies were tied to solid ground and a region would have companies in them . now we have holding companies and the companies in them should be taxed not HC's in other regions. this is tantamount to me moving to serbia in the old game and having to pay fyrom taxes.

to explain lets ignore the embargo. fyrom should get the country a taxes from that and we the 20 % still. if the region is in fyrom. in short that old update should be coded out.

tbh i dont have time to go through it . you need an editor to make your articles shorter and more readable damnit. else most people put it on the backburner and never get to it.

are you a sensitive lad rusty?

only when the missus puts clothes pegs on my nipples and drops hot wax on my chest

Well, clearly not that sensitive then.

God, how much food do you consume every day? xD

three chicken and half a lamb oh you mean my character multiply factories by 10 +- 5700 energy just working in my factories.

Did you wrote message to admins about that?

yep