{eIre MoF} Ministry of Finance

•

by

•

by Rusty D

Greeting's eIreland,

Before we get started, the Department of Finance would like to congratulate Machiavelli on his recent victory in the CP elections. We are happy to work with him and with Ireland to try and acheive success in the financial sector for all of Ireland.

We must also warn our readers, that this article might seem a bit boring or even the old 'TL

😃R', because it will present figures as they are, not as guesstimates, we will show true maths and not assume anything, we will also not distract you with videos that have nothing to do with the economy of eIreland. This is not to make you fall asleep, but it is because we feel that Ireland deserves professionalism when it comes to your money matters.

The DoF this term will be wide and open, for all to ask questions freely, to see money movements in the light of the day. After all this money belongs to you the people of Ireland and not one person. The DoF will be releasing weekly updates as well as breaking news if the need requires. We will attempt to inform the people of decisions being made and why they are being made. As well as keeping a close tab on all money movements.

But before we get into the nitty gritty, please let us talk about the different aspects of the financial sector in eRep... I did warn you it might be boring.

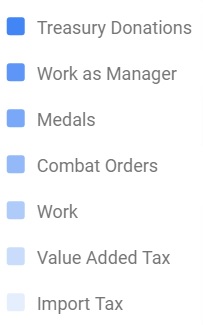

As you can see from the image above, the countries Daily Income is the total amount received from different area's of the game. These area's (which I will go into greater detail below) can vary from day to day depending on what is happening in eIreland and the eWorld as a whole. Some of them are effected by wars/training wars, some effected by individuals, some effected by occupiers and some is effected by military units. Having an understanding of each of these area's as well as accurate recording, helps the government and citizens plan for a profitable month and to make wise economic decisions. Not caring for or understanding these individual aspects, will leave the country with a lack of information to perfect any decent changes in it's economical future.

Donations can come into the government coffers for a multiple of different reasons. It can be from the government moving money from an Org back into the government coffers, from a private individual depositing money into the government for use or for payment of a service (Org rental for example), from an overseas government depositing money for something (payment of a MPP, payment of region rent etc).

Donations need to be record as they play a major role in the 'idea' of a countries financial strength. If they are not recorded on deposit, they could be mistaken as the country making 'profit' or even cause confusion to Orgs being emptied and put back into the government. Sometimes the donations are used to 'fluff' up a budget to show the public that the country made profit, when in fact, it was faked by allowing a donation.

This term, the DoF will record every deposit into it's coffers. When we have the information from the source or reason it was deposited, we will include that in our balance sheets. When the source is unknown, we will mark it as unknown. While the aim of the DoF this term is to try and be profitable with out donations (the balance sheet will show donations separately to allow for a better understanding of the effects of our taxes), there will most likely be donations through out the term. As people have already offered to help pay for MPPs when they arise.

Work as Manager (or WaM) is one of the main forms of tax incomes the government receives. While the past term WaM has been low, due to the fact the one of the past dictators foolishly voted for a trade embargo on our occupiers, the DoF see's this sector increasing this term as the Embargo's come to an end (at the writing of this article the last one with MKD will be expiring).

The effects of the embargo reduced the ability of Irish citizens from WaM in any of their holding companies located in the occupied regions. However with this ending, the Irish citizens effect by this outlandish law, will once again be able to WaM with out hindrance. They will actually be able to reap the rewards of occupation, by cashing in on the Spanish bonuses as well as the MKD bonuses. While this will increase their outputs in their factories, occupation dramatically reduces the tax income from all taxes (more about that later).

Medal Tax is the tax that Plato has placed on a few of the medals issued for service in eRepublik, these include Mercenary, Freedom Fighter and True Patriot. This tax income can vary greatly day to day, depending on what is happening in the eWorld. While two of them are easy to gain any day of the week (Merc and Freedom), True Patriot is done via wars with your home country, be it a direct battle or a Resistance War.

Depending on the course of action the government chooses, we should see a slight increase to this amount during any RW's taking place, or if even a potential TW if one is put on the table. These wars, help both the countries income and citizens income.

Combat Orders tax income comes from the tax levied on MU's CO's. For instance if an Irish military unit sets a CO on one of it's battles, the government will get a percentage of that money. While like donations, this is hard to trace, the DoF will try and link any Combat Order tax income to which MU has set the orders. This tax will be added to the overall tax income, however like the other tax income streams, it will be seperatly tracked to allow the DoF to understand where the country economics need any changes.

The DoF believes this tax income will be helped by the plan DoD 'National Strikes'. And from this we should see a corresponding tax increase on these dates.

Work Tax is a tax rate set by the government (currently at 1% across the board). It is the tax earnt from workers working in eIreland. Over the past month, this tax has not been effected by the embargo law, however like all of Irelands taxes, the large percentage of it goes to our occupiers. Hopefully if the DoFA and the government can get regions back, this daily income will increase, as less of the money goes to the occupiers and more of it goes to eIreland.

VAT is basically like a GST or Sales Tax. This is the tax levied onto products made by Irish and for sale on the Irish market. This tax income has been low, since the embargo has effect quite a few of our local producers, but with lifting of the embargo and as our home grown industries restart their factories, we should see an increase in the income of the VAT, as more people produce and place items on our market.

Import tax is the tax that is levied on products produced and sold on our market from oversea's suppliers. Oversea's suppliers can access our market via market licences that are purchasable in the 'company screen of the game'. While the government can directly alter the import tax (lower the tax, more inviting it is for overseas producers), this sector is more up to the whim of the producers themselves.

This term the DoF will be working in different area's, these include:

- Keeping track of all financial dealings of your elected government and presenting the information to the public.

- Push for a reclamation of the countries Orgs.

- Once Orgs are secured, look at playing the Money Market as well as renting out unused Orgs for increased income.

- Monitor the effects of the lifting of the embargo's and seeing where any tinkering in taxes could be done to provide a better market for the Irish citizens to buy and sell products.

- Assist the people who have been hurt financially from this embargo.

- Work with the government on ensuring their desires are financially feasible.

- DoF articles to be moved to the official newspaper of the Ministry of Fiance.

- Weekly updates.

- Creation of a starters program.

- Creation of a business program.

Currently the Irish government has access to 464,947.41cc and 41g (8,200cc) in the government coffers that is secured. It also has more then 23,000cc which is in unsecured Orgs, but it is being monitored.

The projected expenditure is yet to be discussed by cabinet, but it will no doubt involve an allocation of funds for MPP's as well as any social programs the government plans to run. All this will be taken into account when projecting a profit/loss scenario.

As stated above, this past term, the citizen's of Ireland have suffered under an embargo, which has limited their ability to work and earn a living. Due to this the DoF would like to offer an embargo relief package. So for any Irish citizen who comments below, you will get 500cc and 1000Q1 food (Privately funded relief package).

Looking forward to serving you,

Your DoF team and current government.

Comments

Well that was good, nice article bro

tl:dr.........but I will when I get time 😛

Rusty's articles are always tldr 😐

need to explain the different taxes rather then just say "Our tax income is basically 400", I prefer to fully inform people.

Successfully transferred 1000 item(s) to wittyprakash

You have successfully donated 500 IEP. If the user accepts, the amount will appear shortly in the citizen account.

Successfully transferred 1000 item(s) to Winston Hope Smith

You have successfully donated 500 IEP. If the user accepts, the amount will appear shortly in the citizen account.

Cash transferred to my MU

I'm sorry for Ireland. Wish you gl!

the like a boss video might get you banned it did get me fp's when i used to release a like a boss section. tbh i dont have time to go through it . you need an editor to make your articles shorter and more readable damnit. else most people put it on the backburner and never get to it.

tbh I dont care what you think.

Successfully transferred 1000 item(s) to Releasethe Krakken

You have successfully donated 500 IEP. If the user accepts, the amount will appear shortly in the citizen account.

also you did not account for wam income from foreign companies. something i suggest we take up with erepublik.

do you even know what your talking about????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????? Just go back to your guesstimates.

And no you dont get a second lot of drops

Work as Manager Income Tax will be shared between the Country where the Holding is based and the Country of the manager’s citizenship, as follows:

Paid tax: 80%(Holding Country work tax) + 20%(Citizenship work tax). As a reminder, for Work as Manager, the Income Tax is paid based on a Country’s average salary and Work Tax law.

Example: Citizen works as manager in a Holding located in Country A and has citizenship in Country B. He will pay 80% of country A’s Income Tax (to Country A) and 20% of Country B’s Income Tax (to Country B ).

and that is what I said in the article:

"While this will increase their outputs in their factories, occupation dramatically reduces the tax income from all taxes"

Please learn to read.

Voted.

Successfully transferred 1000 item(s) to David Allenkey.

You have successfully donated 500 IEP. If the user accepts, the amount will appear shortly in the citizen account.

One of the best MoF articles I have read for months. Voted ofc

you just want free stuff.... sent anyway

free stuff is always good but It is the truth 😛

Cheers brother. I will do an update on Sober Sunday, which will be more to the point

Huh. I learned some stuff.

Relief pack dropped.

Nice article. Good luck!

Relief pack dropped.

Voted!

Relief pack dropped.

Good luck in your new job, don't donate anything i don't need it.

Energy and Money donated to the government treasury on your behalf o7

o7 Great Article, looking forward to a great DoF this term!

Relief pack dropped.

Thought it was an RTK article at first. Someone needs a class in apostrophes and when not to use them. Also, I before E except after C and sometime Y.

I dont do spell check, you will soon get use to it.

Supplies sent

Excellent job for one more time bro 🙂

Ireland is very lucky 😉