[eIrish Finance] update 2

•

by

•

by Sweet Drinker

Finance Ministry Update:

Taxes are finally reset from their previous “none-for-Lithuania” economic strategy. Everybody’s interest is focused on the 3% Work Tax. This rate is ofc to improve our mpp treasury budget from ‘f-all’ to ‘a handful’.

We’ve been discussing the possible impacts of upcoming game changes, and are likely to continue targeting a low WT rate to encourage development on eIrish regions.

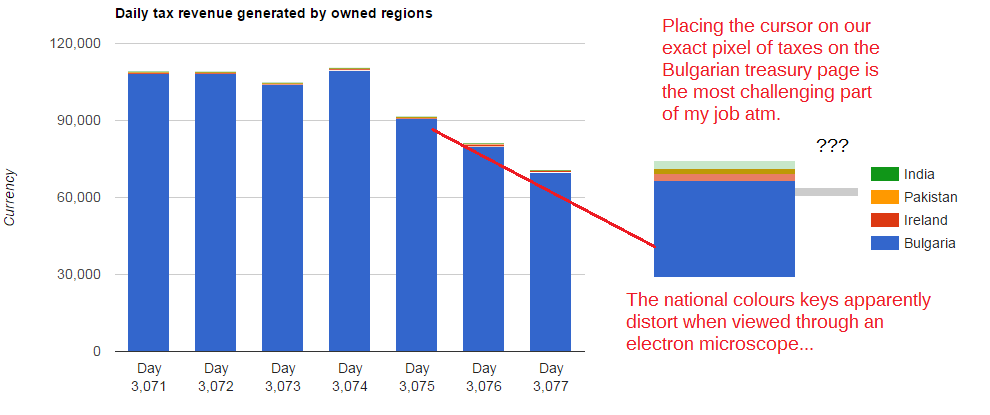

Bulgaria agreed to pay back any taxes they collect off our regions during this defensive arrangement. The tricky part is getting your cursor on the pixel representing our amount!

The foreign CO donation mentioned in the previous MoF article has been returned to the donor.

The National Reserve has disappeared with the outgoing government. The eIrish State was declared bankrupt upon receiving refusal to return the reserve from the previous government. With no State Reserve to care for, the State Bank does not exist. Therefore the eIrish State Bank is officially closed until further notice.

As the treasury is now the only public money in existence, it is the only money within Ministerial or Public purview.

By leaving the current administration with no National Reserve, the previous administration has effectively privatized all eIrish State Programs. As the Military Dictatorship’s primary objectives are military, the funding for its operations are supported by a consortium of eIrish private defence investors.

There has been unprecedented interest in eIrish defence investment from a diverse cross-section of eIrish and former eIrish players (srsly, RtK & I are part of the same program.. you don’t see unity like this very often). While the Irish Army’s size and appetite are rapidly expanding, the Military Dictatorship appears to be quite capable of deploying and maintaining its operations indefinitely under current game mechanics.

Relieved of responsibility to any public assets by virtue of their absence, this has been the easiest (laziest) Finance term I’ve ever served. The new tax rates were a council discussion. I was happy to go with the group decision. We’ll discuss them again down the road if someone has a legitimate point to make against them.

With the recent announcement of major game updates, all longterm financial strategizing is a pretty entertaining but meaningless game of “but if…”. The money markets are highly volatile in response and you should expect to see things get pretty crazy out there. I hate giving ppl personal account advice because everybody has got different goals/circumstances.

For what it’s worth: I’m currently just split across gold/cc. This is an easy way to avoid eating losses during unpredictable monetary conditions because the gain/loss basically cancel each other out. That is easy for me to say however, having all these Orgs to flip currency when the opportunity arises.

The product (or loss) of any revenue generation program based on private capital is the property of the investor. If you wish to use an Org for a private revenue generation operation, contact me. We’ll probably lend you one to use if you’re not annoying.

It has been a pleasure working with the private and military sectors towards the objectives Dictator Sluagh set forth to accomplish. All achieved within a single month. The fact is that mercenary damage has been a primary component in eIrish defenses for years. Developing a large, strong, and well organized military is a much more desirable investment of resources than pouring it into the CO-shredder when we get into trouble.

eLife is,

Sweet o7

Comments

Voted

v

Thank you for the update.

Loved the style of article, thank you for funding the Irish Army!

Here's 25 cc. Now you can double your tax income.

lol'd

Nah, imma imbecile the shit outta ur 25cc

sweet just select show as table and it will show the exact amounts bulgaria gets

Revenue source Day 3,072 Day 3,073 Day 3,074 Day 3,075 Day 3,076 Day 3,077 Day 3,078

Ireland 376.12 252.05 425.39 318.28 816.00 755.64 893.42

pfft i never play on easy mode! 😛