[MoE] Resource Wars And New Rules

•

by

•

by Eduard Douwes Dekker

Oj!

Resource Wars just ended for eCanada.

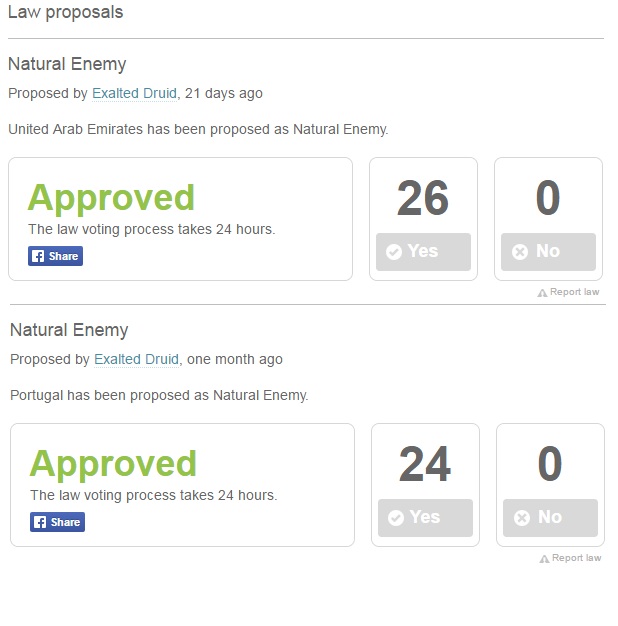

For this event we have organized training wars with our friends ePortugal, eUnited Arab Emirates and eSerbia. Also eAlbania was here for a while. We can thank them, especially eSerbia for everything we have accomplished in the last 30 days.

Congress and Government did amazing job and worked together with Country President and he, Exalted Druid, without any dispute is the man responsible for this outcome. Huge effort from Exalted Druid and finally a real eCanadian unity.

This never happen before

😃

Our resources looks like this:

New Industry(1/1): 30% country_productivity_bonus + 30% region_productivity_bonus

Weapon(4/5):90% country_productivity_bonus + 90% region_productivity_bonus

Food(4/5): 85% country_productivity_bonus + 85% region_productivity_bonus

House(4/5): 90% country_productivity_bonus + 90% region_productivity_bonus

All in all 4/5 in 3 industries and one but one of 4 in the world in new industry. 4 very rares and 3 rares.

Here are some of the new rules that you must know if you are a virtual erepublik economist:

-You will be able to place your Companies in one or more Regions of your choice, after the event ends. Once a Company is established in a Region, the Company can be relocated for a cost (relocation is subject to constraints that will be announced later on).

-The Country productivity will be calculated using the current formula, as the sum of resources bonuses for each industry. If the region is not linked to the Country capital, half of its resources productivity bonuses will be used in the formula. If the Country has 2 or more Resources of the same type, only one will be used in the formula.

-The productivity of a Company will be computed as the sum of Country productivity bonus and a percentage of the productivity bonus of the Region where the Company is located. Regions will be affected by a pollution factor that is based on the number of “works” done in the Region in the previous day. Basic formula : productivity_bonus = country_productivity_bonus + % of region_productivity_bonus - pollution

How will all that work with pollution we have no idea at this moment. We still don't have all information about pollution.

-You will be able to work as manager in a Company only if you are located in the Region where the Company is established.

If the Company is in a Region (historical or under occupation) of a country that has an open War with your Citizenship Country, your productivity as manager will drop.

The Work Tax percentage for WAM (Work as Manager) will be the one of the Country where the Company is located. The tax income will be split unevenly between the Country where the Company is located and the the Country of Citizenship of the manager.

-You will be able to hire employees on the job market of each Country where you have Companies established.

You will be able to assign “works” between your Companies no matter where the work was acquired or the company is located. This is subject to change in the future.

The productivity of an employee whose citizenship country has an open war with the country of citizenship of the owner of the company will be affected, and the salary received will be based on that productivity.

Questions and Answers

Q: Will direct route to capital have any effect on productivity?

A: Rules regarding direct route to capital remain unchanged for the time being.

Q: Will I be able to put my Companies in different Countries?

A: Yes.

Q: Will I be able to move my Companies from one Region to another?

A: Yes, although there will be constraints and costs associated to a relocation.

Q: Will I be able to hire workers based on where my factories are? or only based on my citizenship?

A: Based on the locations of the factories.

Q: How will workers be taxed on their wages (based on my citizenship or location of my Companies)? What if use factories in multiple Countries?

A: Employees taxation will remain unchanged, as they are taxed based on their own citizenship.

For more info you can visit forum

To be honest this is just rough review. There is too many unknowns at this moment. Please stayed tuned and check out forum and update page for more details in the future.

If there are some mistakes please inform me about that, I am just a man after all and this was one quick article

😃

Vote, Subscribe, Endorse and Shout!

Minister of Education

Ministre de l'Éducation

chopp dks

Comments

[MoE] Resource Wars And New Rules

http://tinyurl.com/h2ltgxe

Read eCanada!

Congratz o7

You are definitely one of the target destinations for my companies. Perhaps I'll just move them all to eCanada, I have only two food companies which are basically just for augmenting my regular food use, even that not in total, so I don't really care about full bonuses in food, only in weapons and housing (+ possibly the new industry, we'll see what will that be and how will it work).

You are more then welcome just wait for a while to see where we are at this point 😃

Good reading

&

Congratz Canada!

o7

o/

dje srpska zastava 😃

U srcu 😃

Nice write-up mate, voted and shouted!

Good job everyone o7

Just goes to show what we can do when we have a leadership that brings people together as opposed to dividing them. Well done Druid and all.

Yup, all together 🙂

guzica confirmed o/

Guzica bre!

Gee, it only took the devs what, 4+ years to make some kind of a attempt to scale back working as a manager, the biggest mistake they ever made! (hyperbole, but not by much) *slow clap* Way to do something multiple years to late guys.

Kudos to our Government though.

Way to do something multiple years to late guys. THIS! 😃

Very nice, congrats!

Well done Canada!

what is this aboot, ey

Just some random crap 🙂

okay so im confused , what is the best strategy for working as a manager ? should i locate all companies in one region and be stationed that to be able to work them all as a manager without having to travel?

and if that region got occupied i wont be able to work as a manager ?

am i right?

Yeah, something like that. All companies of the same industry in one region with high productivity of that specific industry. You can work even in occupation cut with less productivity.

There is too many unknowns, we must wait. Don't forget they say the way of traveling will change also.

I feel thoroughly educated.

You should, it's a damn fine article 😛