[UK - MoF] - Bank of England - Financial Report June 2021

•

by

•

by Bank of England

As end of Day 4,950

Reporting covers period 4,273 to 4,950

Introduction

I knew it had been a while since a financial report was published by the Bank of England however hadn't realised it had been 677 days!

Of course, Country Presidents and the more active Parliaments had been given updates on request. Some Country Presidents have also covered some financial matters in their own updates from 10 Downing Street. I've had a few financial discussions with UK citizens over the period. So data and information has been available however nothing quite matches in terms of a summary of all our financial comings and goings as a financial report.

As it's a long period I've kept it high-level. I believe I cover all our tax payer funded outgoings however If I've forgotten a scheme please let me know.

Anyways without any further preamble

UK Revenue (4,273 to 4,950)

£39,988,096.72

Sources daily tax revenue generated by owned regions, currency generated from monetary market trading, resource concession fees and returned tax revenue received from occupiers as part of training war agreements and tax revenue received from occupation as part of training wars

Breakdown

Returns

£18,145,006.26 Returned to Spain as per resource concession agreements

£605,195.00 Ukraine Tax Revenue returned as per training war agreement

Income

£8,831,319.74 Daily tax revenue generated by owned regions and returned tax revenue received from occupiers as part of training war agreements excluding resource concession fees and returned tax revenue received as occupiers as part of training war agreements

£8,438,857.77 Currency generated from monetary market trading

£3,967,717.95 Currency kept as per resource concession agreements

Treasury and Organisations

£139,878.15 Treasury (as of Day 4,950)

1,630.55 Gold Treasury and Organisations

£11,772,350.69 Organisation Assigned for Monetary Market Trading (includes investment and invested profits)

£953,116.62 Other Organisations

UK Spending(4,273 to 4,950)

£12,279,855.78 - All sources UK spending funded by UK income excludes private spend on behalf of the government

Breakdown

£4,951,608.54 Q7s weapon stockpiles and supply drops .etc*

£2,222,940.00 Funding for Air Schemes ("Christmas Air Programmes" Air Cadet & Pilot Rewards, Air Rank Up Schemes .etc)

£1,185,750.00 Housing Schemes ("Right to Buy Q1" 'Help to Buy' a Q1 House "Council Housing Grants" "Q1 House Grants" .etc)

£1,873,835.00 Tax Revenue lost during occupation

£1,000,000.00 Revolution costs

£450,000.00 Airstrikes (x3) - USA, Ukraine and Canada

£373,120.00 Dictatorship Upkeep Costs

£126,740.00 Resistance Hero (Benched) Compensation

£50,000.00 Mutual Protection Pacts

£37,199.74 Q5 food stockpiles and supply drops .etc

£8,662.50 Compensation to loss of Production Scheme (Scotland Occupied .etc)

107.3 Gold** - Declare War (x3) - Greece, Bulgaria and Iran

*To note the UK has a Q7s Weapon Stockpile totalling 16,424 units remainimg

** To note the costs of 2.5 DOWs were reimbursed

Bank of England Monetary Market Trust

As a reminder, the Ministry of Finance is taking advantage of the gold price on the monetary market by operating a Bank of England Trust for citizens and allies to invest in.

Eight citizens have invested into the Trust. After a period of temporary suspension, the MoF will be placing monetary market offers once again from a number of eUK Government Organisation reserved for use by the Bank of England. The monetary market profits have been agreed to be split 60% to the citizen and the remaining 40% for the Treasury to reinvest/store in reserves.

Please get in touch to discuss this further or declare your interest in investing into a Bank of England Trust.

Training Ground Loans

Upgrading your strength buildings is the best way to earn income as it allows you to receive Super Soldier medals much quicker. A Q4 Weights Room & Q4 Climbing Center (without any contract training) earns the most money of any training/contract combination. Together they will earn you 13.38g/month (0.446g/day) after you pay the daily training.

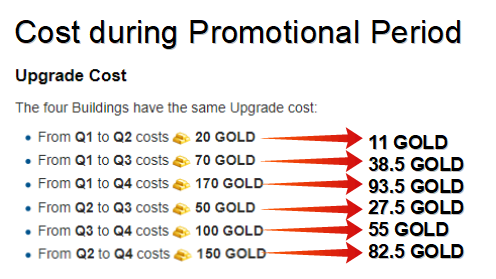

During promotional periods training ground upgrades are reduced;

To upgrade your Weights Room, Climbing Centre, Shooting Range or Special Forces Centre it costs 45% less for each incremental rise in quality.

The Government can support upgrades today with a loan of up to 10 Gold today, to citizens to help them upgrade their strength buildings during the training grounds promotion.

Contact the MoF to discuss a TG loan.

Monetary Market fishing Guide - Republish

Monetary Market (MM) fishing is not new and there are many fine guides however here is a brief MoF guide as a refresher and to introduce the concept to younger citizens who may not be aware of it.

At the current market rate it is most optimal for a citizen to invest £5,000.00 into a MM fishing. There is two reasons for this;

1) The current and fairly long-standing exchange rate for 1GBP has been 0.002 Gold.

2) The daily gold limit for most citizens is 10 gold.

Therefore the maximum currency you may sell at the current exchange rate is £5,000.00 for 10 gold.

It will take around 10 days for your currency offer to sell on the monetary market. This will give you 10 gold. It is worth noting that the amount of currency you sell can vary greatly, sometimes all the currency you put on the MM will be bought and sometimes you don't sell any. Offers do expire on the MM, however, any currency that does not sell is returned to you

Place this 10 gold onto the monetary market at the current exchange rate (around publications this was 1 gold for £546.00). This will result in the 10 gold selling for £5,460. Once you subtract your initial investment of £5,000 you will have generated a profit on your investment of £460.00 for minimal effort.

Close

For any further information don't hesitate to contact the MoF.

Minister of Finance and Governor of the Bank of England

Huey George

Comments

Great work Huey, o7

Very detail..

Good job o7

Well done Huey, excellent as usual o7

Thanks Huey