[CP] Impact of Black Friday on NL income (and why it is vital to save for it)

•

by

•

by Het Catshuis

Greetings citizens of the Netherlands,

Black Friday - event, which happened 5 months ago, and which will hopefully happen next November again. Why do I talk about Black Friday now, at the end of March? Because now we have the perfect amount of data to analyze the impact of Black Friday on our tax income. Spoiler - it is quite large.

Before we start - there are also other attributes besides Black Friday, which improved our income a lot. Some of them will be shown in the graphs below, some of them will not be mentioned. For example rental concessions (which deserve their own special economic category). Or inflation of average salaries, which is making tax income slowly but surely bigger. Or Dutch players returning to the game or accepting our citizenship. Friendly governments, plenty of programs beginning to sprout, and in-game activity replacing the Forum game motivated those players to come back, and our income certainly flourished thanks to all these factors. However - Black Friday, one single day of a year, managed to beat it all.

... even though it wasn't as great as this picture shows.

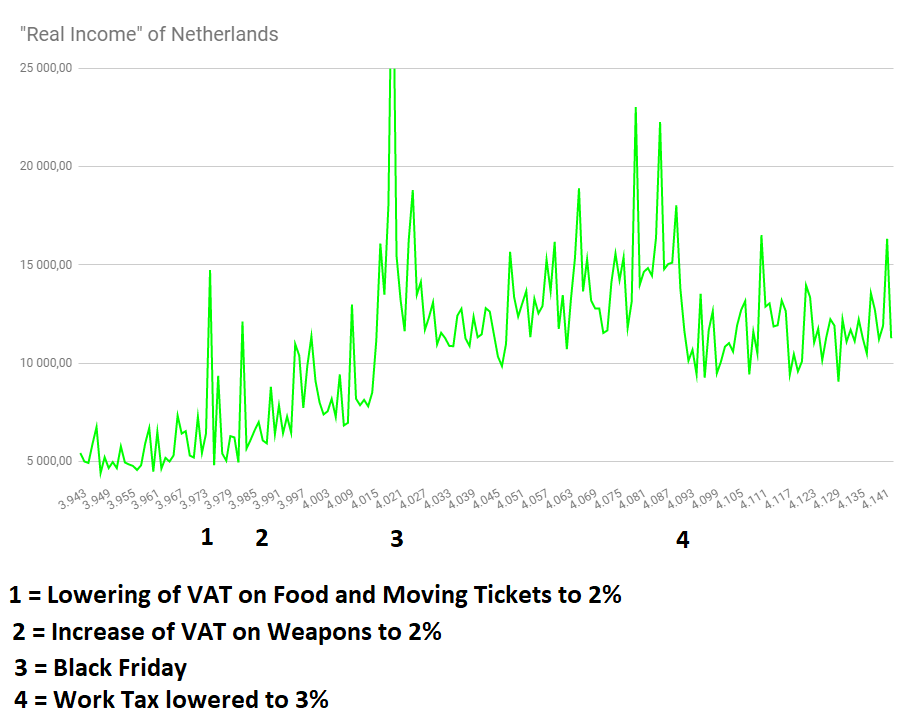

So, let's start by looking at the "real tax income" of Netherlands. Due to the in-game income numbers being messed up thanks to Training War and Rental concession (and therefore becoming unusable for calculating actual tax income), Minister of Finances has been working with the term of "real tax income" for some time, which, to use his own words from the Finance Sheet, means:

Taxes + Accounting for taxes received back from TW + City Subsidies

Sounds easy, but it needs quite a work in the Finance sheet to get the number right. Either way, let's look at our real tax income for the past 200 days, and notice 4 economic events, which could influence it's size.

To describe the graph a bit - we have started at the real bottom (though, if we went more to the past, the bottom would be even lower). The change of VAT taxes didn't do much to economy itself - however the growing inflation, the upcoming events of Day 4,000, and players coming back to join the new progressive Netherlands boosted our economy quite well during the period.

And then there is Black Friday. Suddenly, in one day, our tax income moved on different level (almost doubling it's size) and it managed to stay there. This huge increase of real tax income allowed Congress to accept my proposal to lower Work Tax from 4% to 3% on Day 4,091. But even with lower Work Tax, our income managed to stay on this higher level and it keeps slowly growing, once again, due to inflation.

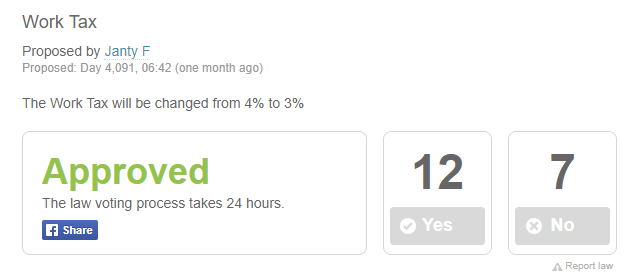

... I hope the NO-believers are now convinced that Work Tax can be lowered, if you do it correctly and with some math behind it

😉.

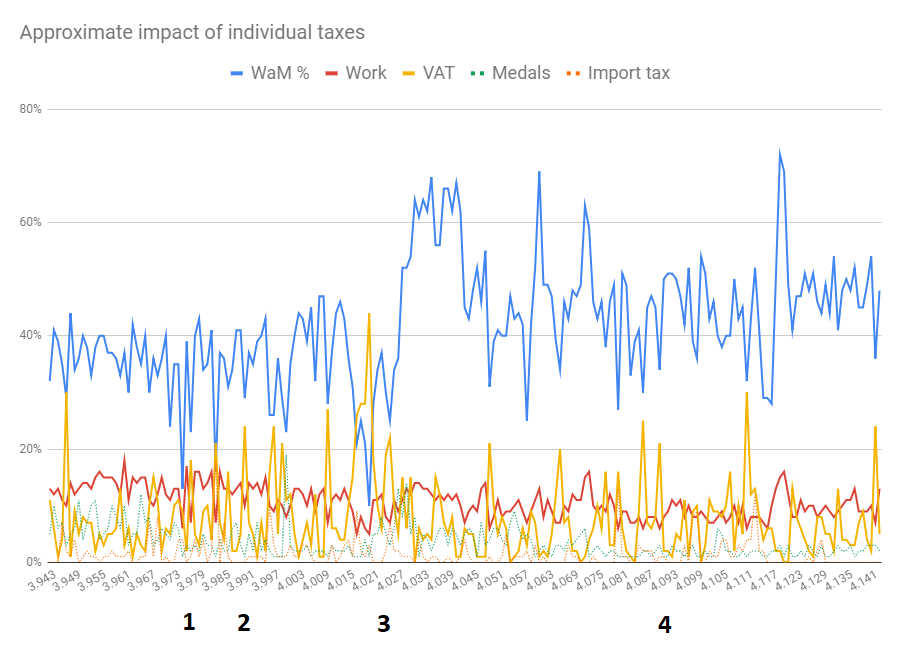

So - just by looking at this graph alone, we can see that the impact of Black Friday should not be neglected. Now let's add two more graphs. These graphs will be a bit trickier. Due to the factors of TW and rental concession and its influence on City Tax, it is almost impossible to say the exact numbers of our income from individual taxes (as we can only calculate the sum). However, we can still compare "percentages of influence of individual taxes" on our tax income. So while we cannot say "The work tax income is 5000 cc and VAT is 1000 cc.", we can say "Work tax income is responsible for X% of our income, and VAT for Y% of our income." So let's look at the percentages then!

... uff, this is dreadful. The Black Friday is still visible due to enormous jump of Work Tax Income at the end of November (while curiously, the decrease of Work Tax remains quite hidden), however all other taxes are just lost in the lower part of the graph. However, we can improve it with trends, so instead of complicated zig-zag lines, you just need to follow bunch of simple lines, as seen below:

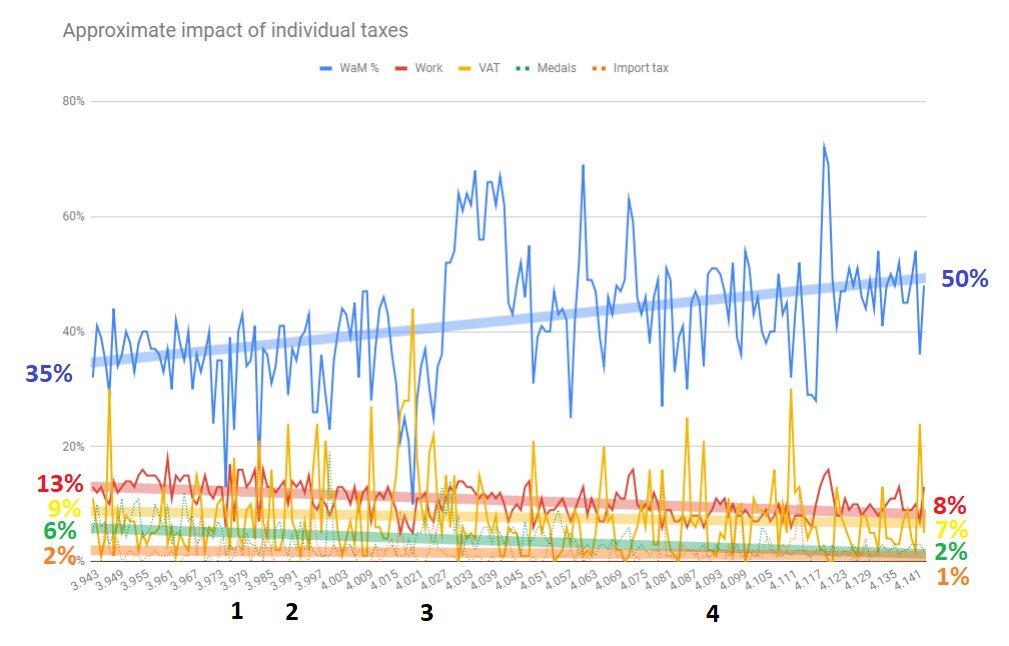

Indeed, we see that Work as Manager Income influence has grown in recent months, to the point when half of our tax income is caused by Work as Manager Income alone. Following that, the influence of other taxes has been decreased - especially "Work as employee" tax income. That in itself is interesting, because it shows the disproportion between the amount of new factories and new employees themselves.

The other taxes also stagnated, as they have no means of keeping up with the growing amount of factories. The stagnation was not that horrible though as I originally expected. I would like to see VAT being more influential though.

This graph, upon further study, might give future governments some ideas on how to operate with taxes. Studies like these might help to decide, when is the best time to lower Work Tax again (as optimist, I believe we will achieve these criteria even before the next Black Friday), how big of an impact will this have, and how to operate with other taxes to keep our income healthy while doing our best for Dutch citizens.

Also - and that is the MOST IMPORTANT point of this article - we need to prepare ourselves for Black Friday. If we do it right, we might boost our tax income even further, leading us to more tax reductions and more programs for players. All while filling our market with more goods, and helping people to obtain more food and weapons for themselves (or houses, we should make some commune on that as well). Win-win situation all along. That's why I plan to save all the remaining budget of this government for Black Friday Fund, which will be used at November to subsidize our long-term playing citizens to allow them building new factories. And that's why I urge the future governments to follow my idea. Because this investment is really worth it!

Comments

o7

neat analysis

Yay, finally someone notices the ''Real Tax Income'' Metric 😃. It should be very apparent that our financial situation is steadily improving. Not only due to Black Friday or Inflation (which is not a real ''improvement'') but also due to sound financial investment by recent Governments (most importantly on the Monetary Market, although that is not the subject of this article).

An important step for coming Governments is to deal with the situation of 'poverty' in the past to one with abundant amounts of money. Which is why a decrease of Work Tax should not be an automatic step, but a well though-over one. We need to think about investments and not about cutting Taxes immediately, because in the end we're still a small nation that only can counterbalance its size by sound financial management. Therefore I fully support the ideas to contribute to a special fund for our Industry for Black Friday!

* BTW, our VAT has seen a slight increase thanks to the ''Housing Program'' in which there is a promise by the Government to bring Houses on the Dutch Market for the Program. Initiatives that should be extended to all consumer goods! Socialized Weapons, where are thou?!

I agree. I do not think we have to decrease the WT for now. I do not buy the argument of decreasing it because of black Friday. I think a decrease needs to happen when the tax burden per company is too high (if salaries keep sky-rocketing like this it won't be in a very long time...), not because there are more companies contributing to the WT pool.

But yeah, if there is a company discount, seeing something so that new players can be self-sufficient in food or something like that would be nice.

Honestly, the tax burden per company is quite horrible lately, especially due to low prices of final goods. Usually, I had to pay much more for raw materials instead of paying the tax. Now these two expenses are almost similar. Can't imagine, how companies should remain profitable, if the situation goes even worse. Though, with cheap tanks, it is better to hunt for medals, so that's a positive for some people 😂

Either way, Black Friday is here to offset any negative impacts of lower Work Tax. You do not need to lower Work Tax just because of Black Friday. But without Black Friday, the lowering of Work Tax would be much more difficult to do 😉 .

I know I know... average salary is going up like crazy, if this continues like this we will certainly need a further decrease.

Well, it's one of the most useful columns there, it deserves more attention. And there is only so much topic for one article, monetary market is entirely different issue, on which I myself lack enough data though, so I can't go into great details on it. Though, it is good to see that we manage to earn money even without taxing citizens more, whether it is Monetary Market or Rental Concessions 🙂 . Let's hope we stay on this positive path!

Also, as you see, I took 2 months of observation after the Black Friday, before I dared to suggest decrease of Work Tax publicly. Indeed, tax reforms in small countries need to be done carefully, and with observing long-term trends.... but as the data show, it did not turn out to be the disaster some people proclaimed it to be. As for further reductions - as I said in the article - I am an optimist in terms of tax reductions. I believe in low Work Tax and strong VAT Tax, and would eventualyl like to see them both implemented. I can easily see Work Tax dropping by another percent before the end of the year, especially if we handle Black Friday right. Unless the economy goes totally crazy due to unforeseen circumstances and changes in game rules. Which is why we keep reserves and we remain flexible enough 🙂 .

It is awesome to see such data driven decision making. Great analysis!

Rumors are that after the President has seen economic articles from citizens of other ountries (like Ireland or Germany), he realized he needs to step up his game 😶 .

Either way, I walked a long road from person with no interest in economy of the game, to the person who now collects data to prove his economic theses and writes articles like these. And if it helps this country and its citizens to make some money due to good economic decisions - even better.