[FDE]Guide : National Economic

•

by

•

by Swiss Dep. of Education

First of all, Hallo everybody and respect to our Presidents, and teams and to all party president and to switzerland citizen

This article is a guide for National Economic, i hope you will enjoy this artilce,

Country resources

This is a list of resources country owns. Resources are:

Tax Revenue

Countries can gain additional tax income from the regions they have conquered. The amount of currency collected through taxes is updated in real time both in the country treasury and in the Tax Revenue chart.

The taxes of country under partial or total occupation are divided between the occupying countries and the country that is occupied. The taxes are affected by the number of regions each country holds.

The taxes included in the calculations are:

1. Import tax

2. VAT (Value Added Tax)

3. Work tax

The total income of a country (TCI) is the sum of PCI’s calculated for the original and non-original regions the country possesses.

For example, Finland controls a part of its original regions, but has also occupied regions from Greece and Belarus. Finland’s TCI will be: TCI = PCI(Finland) + PCI (Greece) + PCI (Belarus)

Please note: that even if a country has 0 regions, the base income is still 20%.

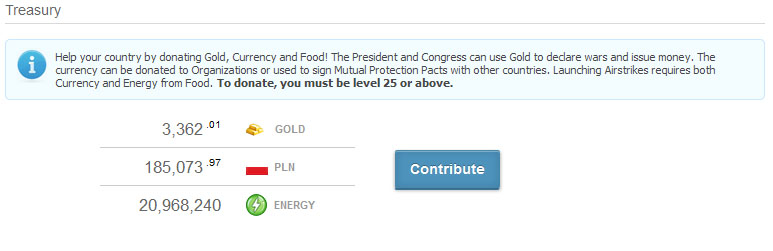

Treasury

Every country has a treasury in which you can find total amount of Gold, national currency and energy which country gathers with different incomes.

The treasury information is displayed on the Economy screen.

Donations

Starting from Day 2,366, citizens are provided again the chance to donate money or gold to countries; in order to perform any kind of donations, they have to be at least level 25.

Minimum donation conditions are listed below:

1. minimum Gold donation = 1 Gold;

2. minimum Currency donation = 20 Currency;

3. minimum Food donation = 5 Food items.

Trade Trade embargo

The trade embargo section lists the embargoed country name, and flag, expiration date.

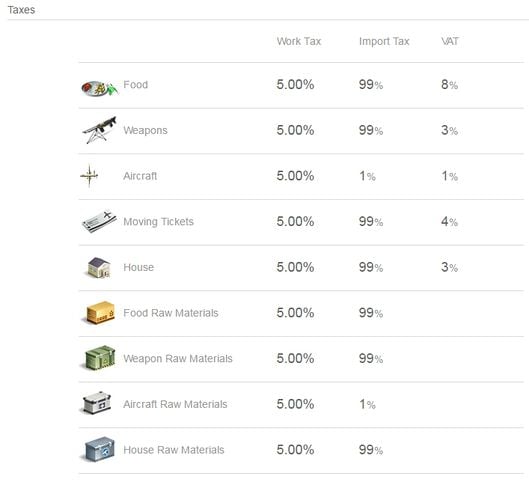

Taxes

The tax section lists for each manufactured product and raw material:

1. Work Tax

2. Import Tax

3. Value Added Tax (VAT)

The VAT is only added on manufactured goods.

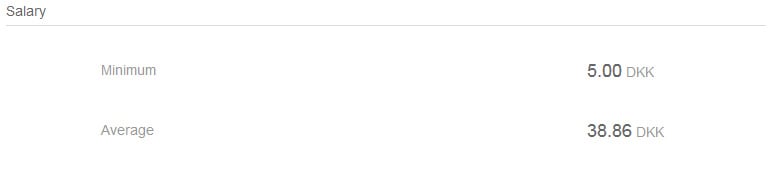

Salary

Minimum salary (voted by the congress)

Average (the average salary based on the last 30 days paid salaries in the country)

Ask the President

Send a question to the President, the answers will be published in the next Presidential article.

Fill the form to send your question: http://tinyurl.com/askthecp

National Cencus

The Federal Department of Population is doing a national census to get a grasp of our active population. Please fill this form: http://tinyurl.com/Swiss-Cencus

Comments

vote \o/

Votado!!!

BUen articulo.

Thank you my friend

Thanks BW.