Simple guide to cross trading - part 2

•

by

•

by Kevin Bartholomew

In the the last article I explained the basic and easiest way to make a profit. For some of us that is not enough.

Cross trading weapons is a little bit more tricky. When you go to your storage and select Q5 weapon a recommended price will appear.

28.20 is the recommended price in most countries for Q5 weapons

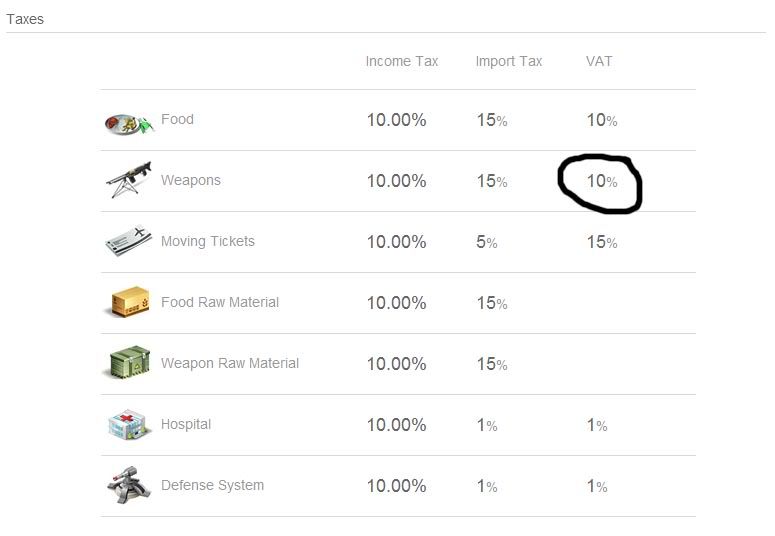

Now the hard part, for some. Look at your country's VAT for weapons. In Australia it's 10%.

Also note the Import Tax to the left.

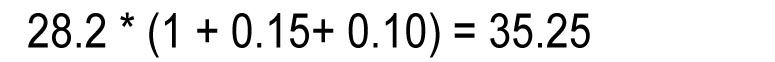

In the next step you have to add 10% to the recommended price. This is the correct calculation:

This is the price Plato will buy for if you're a citizen of Australia

If you want to sell to another country you need to add import tax to the calculation. Australia's Import Tax is 15% for weapons. The calculation will look like this. Where 1= 100%. 0.15 = 15% import tax and 0.1 = 10% VAT. Total 125%.

Use this formula if you're not a citizen of Australia.

And there you have the basic knowledge of exporting and importing items. Feel free to ask questions.

Comments

You need to fix that last formula. It should be 28.2 * 1.1 * 1.15 = 35.673. shouldnt it?

No the outcome is correct. I mistyped the formula, that's true. You should add VAT and Import tax together. 1.1 + 1.15 will be equal to 1.25. 1.25 times 28.2 is equal to 35.25 - the price he's buying for.

I see what you mean now, just to make everyone understan😛

0.1 0.15

0.1+0.15=0.25

Since this is an increase not a decrease you take 1+0.25=1.25

1.25*28.2=35.25

The pictures is now changed. Tell me if something is unclear.

thanks for the info, mate

it's really helpful, well done!

v

vote

Looks good. voted.