The Case for Lower Import Taxes

•

by

•

by Myung Kei

What I usually think of the Monopoly + Economics equation.

Plato, our bi-polar Governor (jk) has announced a sweeping new change to inventory, export licenses, and the economic system of the eWorld as a whole.

Now, you only need one license for all of your companies if you want to export to a country. Although this change seems small, PigInZen analyzes the potential economic impact: people suddenly have all these (now) free licenses sitting around. On a gold standpoint,buying licenses for all your companies are now several times cheaper than before this modification. This was one of the largest barriers to trade due to the incredible expense, now that these changes have been put into place, there is no doubt that an explosion of world trade could occur in the near future.

So today, I am making the case to the ePH Congress (and for the Congress' of Small Countries alike) to simplify the import tax code, and to lower old punitive rates of 99% and the ilk to under 15%,10%, even 5%...now why?

Well, suffer a bit in a tl;dr session:

1)More Global Trade = More Possible Local Trade

Simply put, if more people now can afford more licenses, then obviously they want to make as much money as possible by selling more products. Small countries were looked over because on a market:license-cost ratio, it simply was too expensive for all the trouble. Now, gazillions of companies and businesses have the ability to export much more than they use to...and with so many opportunities for global trade to open up, its fairly obvious that at least a partial bit of the pie should come directly here (ePH is practically the eUS's retirement resort). Now, businesses would not be keen to waste their comparatively now cheaper export licenses for their goods to our country if we continue really weird or high import tax rates (17% MT's/Weapons, 99% Food/Oil/Iron), so if we lower rates, it gives incentives for companies to come to our market.

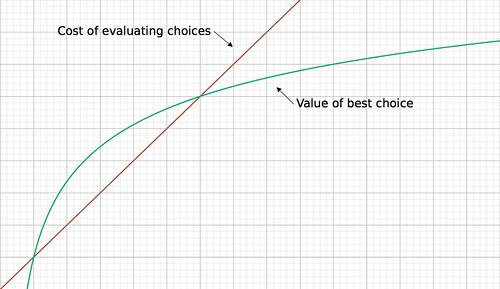

2) Less Burdensome Tax Rate = More Local Trade = More Tax Revenue

Now that more companies are on are market due to the lower tax rate, there is a much greater chance that our people will buy from them. But also since we are collecting taxes on these imports, it would result in a larger revenue of currency to the national treasury. Such an uptick in revenue could provide smaller countries the currency they need to slow down inflating the quantity of money at its present rates in smaller nations (sending increasing revenue to the national bank instead of printing more).

3) Lower Priced Goods

Simple right? More foreign businesses in our country and lower import taxes means possibly cheaper goods. In the end we the consumers win by this growth in competition, and local markets would have to compete on this scale. This is excellent for small countries which have very small domestic markets and require products that they cannot easily or immediately make themselves

VAT and Income Taxes are much more efficient in the long run

With these new changes, even the most minuscule of Income taxes that were received by the "collect button" have been wiped off the map due to the inventory change. There still remains huge and quite often exploited loopholes in the tax system...notably the donation of wages to employees and the local black market for products. Although it is possible for people from one country to another to sell products on the black market, the truth is that it for the normal exporter, it is too far of a connection and too much of a hassle internationally then the guy down the street. A low, but stable import tax rate, would mean an net zero loss in revenue, and perhaps even more revenue gained due to more trade.

Our eCurrency is negatively affected by this.

If these corporations that now sell goods on our market and collect our local currency, eventually they would need an exchange. If you take an eCurrency outside the country, it is practically worthless. The only way to use it is to give it to someone who thinks it has value (to spend it later), or to buy something on our market place in return. People just don't collect it and stuff it under their mattresses for all of time; the total impact of more imports on the eCurrency is minimal to say the least (some still might forget, and others banned, etc).

Higher Import Taxes would protect jobs and local industries

Our economy can no longer stay so isolated, and now we must ask, at what cost to us? Several statistics have been made to show that several of our protected industries sell products at much higher cost than other market rates. We the consumers are hurt by a lack of competition, more competition would mean we benefit as well. And not only that, but local industries would adapt and try to compete as well. And if some can't make it, there are literally pages of job offers every day for people to sign up for. The economy is fluid and dynamic, never static.

So yeah, that is about it. I urge the Congress to adopt plans to lower import taxes and set a majority them at a uniform rate (subject to their opinion).

🙂

Also, local businesses: Don't miss out on this opportunity to sell your products abroad to.

😉

Our Corporations:

ON YOUR MARKS, GET SET, SELL!

Our Country:

ON YOUR MARKS, GET SET, CUT!

Comments

Excellent article--a rebuttal incoming 😛

I'm siding with you for now, MK. Low import duties will allow the ePH to get the RMs it needs at a low steady price UNTIL we can get more RM company ownership domestically. Once we're seeing a steady surplus of domestically produced RMs we can close our market. This won't happen until citizens are producing more than 300 health per capita daily.

Your debate makes me want to export to you guys :3

Excellent work!

http://ephilippines.forummotion.com/t2597-taxes#33058 let's make this a quick process fellows, and it's a good article, your multi commented on this article 😛 (j/k!)

PiZ, I make my own RMs (;

🙂 good article!