The Economist ~ Resource rental in depth review

•

by

•

by Spite313

Dear friends,

In my last article I briefly looked at three countries, and how the game changes would affect them: Romania, Russia and Iran. I picked these countries as a sample of one large and two medium sized economies which currently have good bonuses. The initial analysis I did suggested that Romania would do poorly from the changes, and the other two countries would do well. Naturally I missed a lot of economies from this analysis, due to time, and I decided to revisit this today.

Previously I had studied work tax to give an estimate of the largest economies by productivity. The list had a few surprises and a few major countries missing (e.g. USA) due to being wiped. I used that list as the basis for this article, and I have counted the 16 largest economies, plus the eUK because why not. I have missed some wiped countries, or those without their core regions, simply because it’s a pain looking up that data and it would be skewed anyway.

As an advance warning: if you don’t want to read an in depth review, leave now. There’s nothing simple about these changes and no short way to explain them. Please also note that due to the limited information available ingame, I have made some estimates and invented some measures of my own. I will explain the methodology of these as I go through the article.

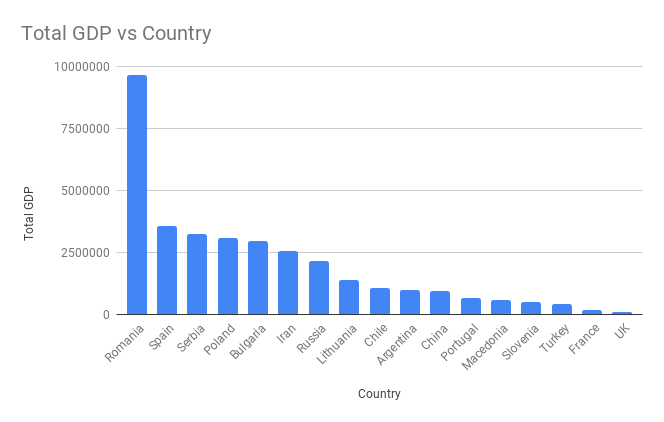

Current GDP by country

Before we start looking at changes, I think it would be useful to first look at the current GDP of the countries we are investigating. This information is taken directly from an average of the last 6 full days, provided on each country’s economy page, rounded to the nearest 1000.

Data table:

This shows there are certain key countries for each industry. Romania, Iran, Serbia, Poland, Russia and Chile together contain most weapon production. Housing is heavily concentrated in Romania, Bulgaria and Spain. Food is more evenly distributed, which isn’t surprising given it’s mostly not run as a profit generating industry and all players have at least one food company.

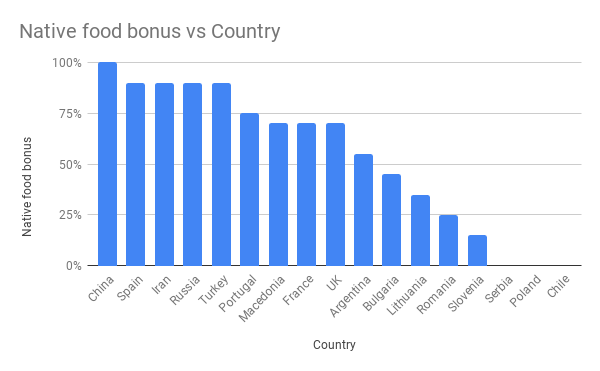

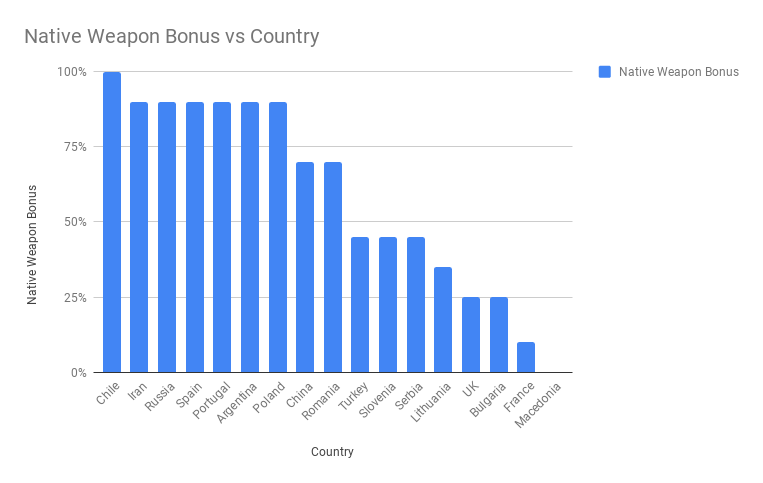

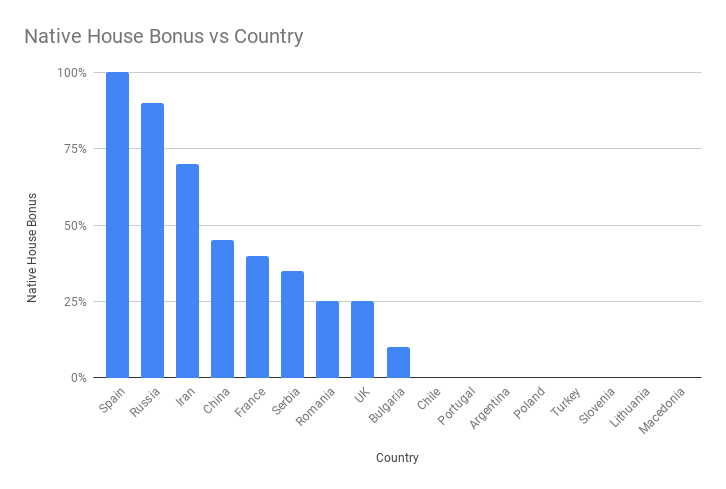

Native bonuses by country

Next let us look at native bonuses (those contained within the home regions of the countries we are looking at). I will show this by industry.

Food

Weapons

Housing

When the changes first come into play, most countries will rapidly lose their empires as determination rises. This will mean that those countries with high native bonuses will be at an initial advantage until rental deals are done. We can see that only China has full food bonuses in its cores, however Iran, Russia and Spain all have 90%, missing only the cheapest and most common food resource, and will be an excellent position to secure this.

Chile is lucky to have 100% weapon bonuses in its core regions. This makes it attractive as an investment location. However Iran, Russia, Spain, Portugal, Argentina and Poland all have 90% resources, missing only iron. This is a very common resource and they should be able to acquire it cheaply.

With housing, Spain’s 100% bonus will mean it could rapidly become the world leader in housing production. However Russia also has 90% bonus and so I expect that most houses will be produced in one of those two countries. Bear in mind that as housing is barely taxed, this won’t be a big advantage for either country unless the admins make changes to how taxation works (and they should).

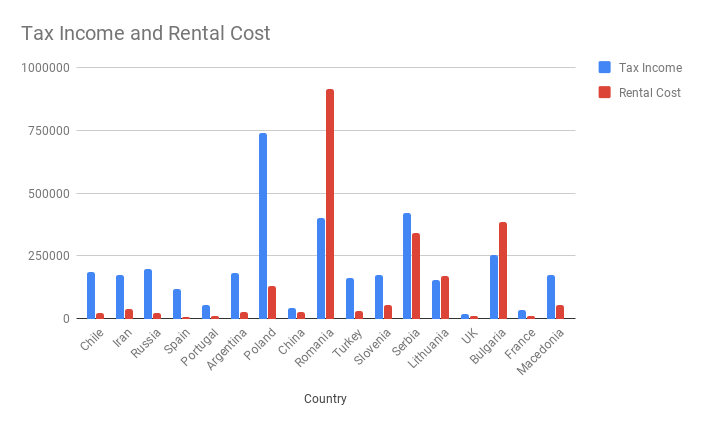

Rental costs

Renting regions is based on the GDP of the country per day. This means if your GDP drops, the rental cost drops as well. To reiterate, the resources cost 1-5% of GDP, from the most to least common.

This means the 10% bonus is worth one fifth of the 30% bonus, but gives one third of the benefit. The other bonuses are similarly skewed. I guess this is because the higher bonuses (25 and 30

😵are rarer and thus more valuable. However in my opinion rather than fixing the cost of resources, the admins should allow countries to set their own price using negotiation.

Although this might be slightly more complicated from a technical/programming perspective, it just makes sense. Consider, a country with 55% bonuses rents a 25 and 30% bonus. They now have 100% bonus, and as a result their GDP will vastly increase as new investment floods in. However the initial agreement will offer a much lower amount, since the GDP will be smaller at that time. This makes them look like a less attractive option and doesn't fairly demonstrate their increased income. In order to compete, the country should be able to offer a higher amount to attract the seller. Setting prices manually would also allow allied countries to provide each other with cheaper resources, or to give a marked up price to non-friendly nations.

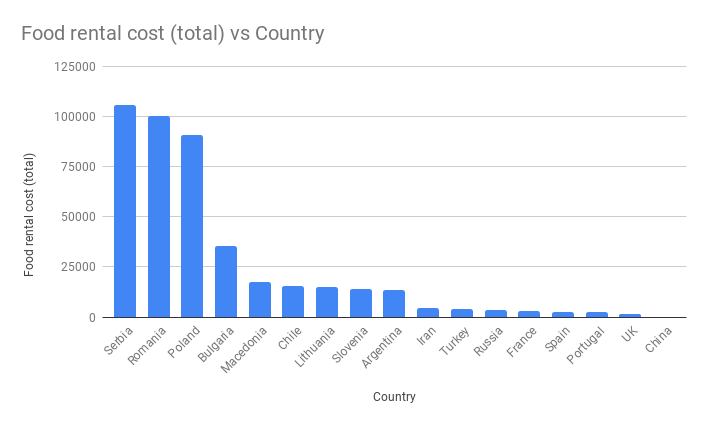

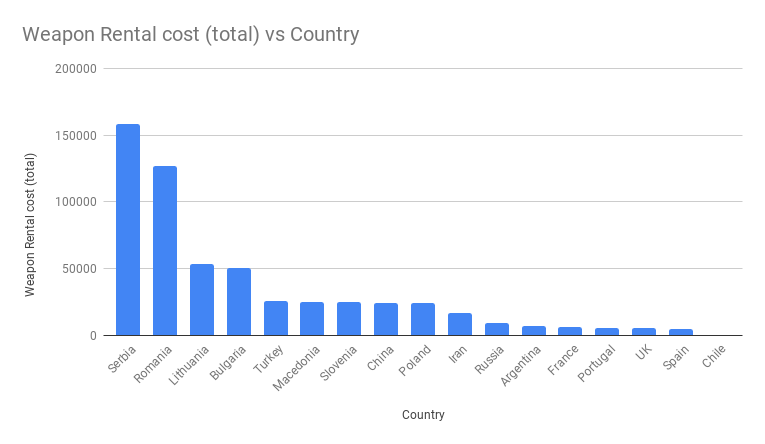

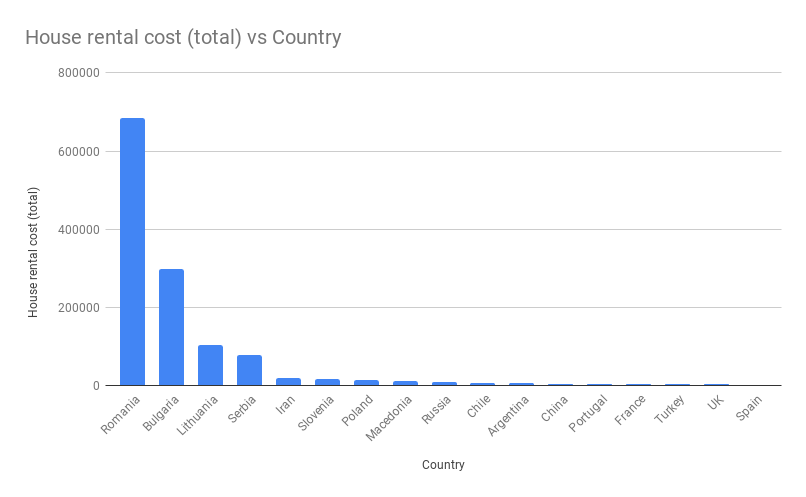

In any case, I have analysed the cost for each country to raise themselves to full bonuses, and this is shown in the graphs below. Please note this is based on current GDP, which will definitely change in the weeks following the changes. Please note as well that nobody in their right mind would rent housing resources since they give no financial benefit to the host country.

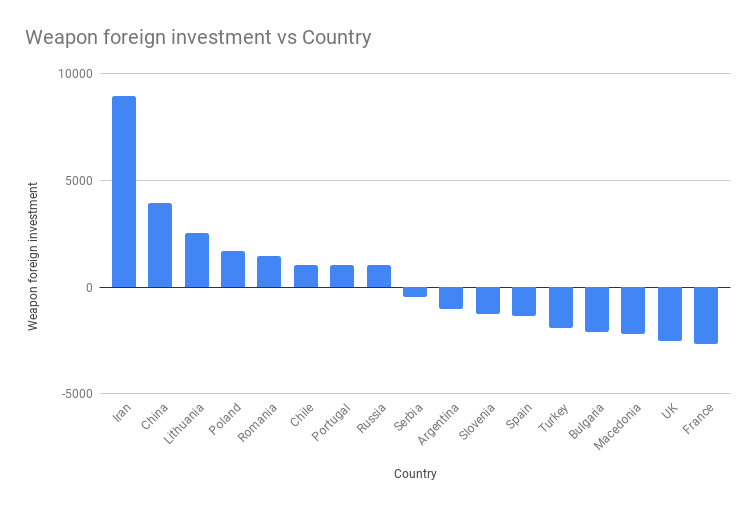

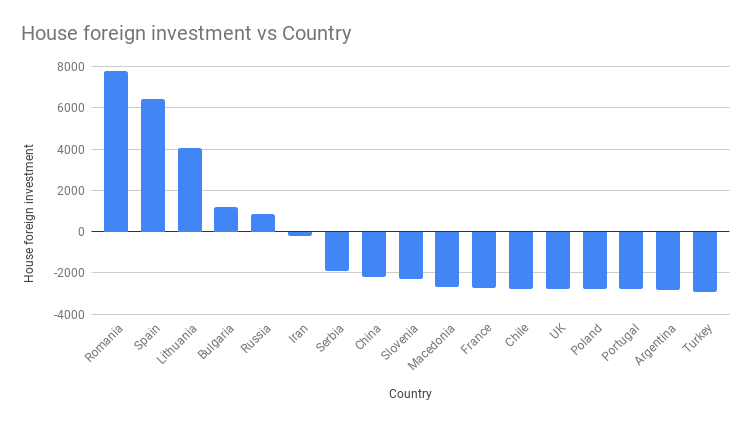

Foreign investment

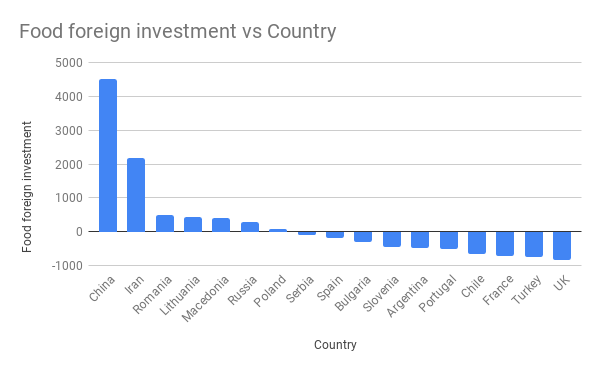

We can consider that some countries have foreign investment, and some countries have foreign investors: i.e. the citizens of those countries with poorer bonuses create holding companies in countries with better bonuses.

There is no ingame way of tracking this that I am aware of. To estimate, I calculated the total GDP of the countries involved for each industry, and the total voters for all countries in the last Presidential election. I then calculated the average GDP per vote for all countries. I then compared this to the specific GDP per vote for each country. Those with a positive value are therefore likely to be net recipients of investment, and those with a negative value are likely to be net investors. This isn’t perfect, since if 16 countries all invested in 1 country, the numbers would not reflect this. But it’s a decent way to estimate.

For example, Iran has a food GDP of 465000 and it had 142 votes in the last Presidential election, meaning the food GDP per vote was 3275. The average of the countries was 1088, which means that we can assume it has a lot of foreign investment in its food industry. Conversely, Turkey has a food GDP of 101000 and 282 voters, giving it a GDP per vote of 358, or a net investment of -730 below the average. See below:

In fact, I think that the bar should probably be moved- and that the likelihood is that my ‘average’ number is actually too high. In other words, the countries towards the right hand side of the charts above actually invest more than this shows, and the countries towards the left receive more. Also worth noting that China's vote numbers may be lower due to the long term dictatorship, and so their investment numbers are higher than reality.

At my best guess, the following are rough figures for total foreign investment per industry:

Foo

😛8-12 million currency per day GDP

Weapons: 20-25 million currency per day GDP

Houses: 23-28 million currency per day GDP

Although on paper weapons and housing are close to the same size in terms of GDP, the housing industry is heavily concentrated and therefore there is more floating investment.

Likely shifts going forward

It is likely that when the admins free up investment by allowing their “one time move” of all holding companies and companies, we will see a few major effects. Firstly there will be a lot more companies active as they get moved from poor locations (currently) to more beneficial ones. A lot of companies will likely move out of the occupied USA for example.

We will also see a big shift in foreign direct investment. One of the reasons I have written this article is so I can do another in 2 months time and compare, to see how investment shifted. I expect the housing industry to abandon Romania altogether in favour of Spain and Russia (and potentially the USA, once it is back on the map). I doubt Romania will burn the money to keep their housing bonuses considering how worthless they are presently.

I think it’s likely we’ll see some shift in weapons too. Romania and Serbia are the first and third biggest producers of weapons, and will have 70 and 45% bonuses respectively in their cores. I expect an initial wave of people leaving, although I expect Romania in particular to secure their 100% weapon bonuses pretty quickly. Likely beneficiaries from the changes are Chile, Iran, Russia, Poland of course and Spain. All of these are powerful stable countries with good bonuses. Likely losers of investment are Bulgaria, Lithuania and Slovenia.

Food I imagine will be fairly stable, given most of the time people produce food regardless. However for those who do so on a big scale, China, Iran, Russia and Spain are all attractive options as they will be able to easily secure 100% bonuses (or have them already).

Options for securing resources

Countries with 90% bonuses in any given area have a simple task securing 100% bonuses. The 10% bonus is very common on the map, and many countries have duplicates. In this case, it will be a buyer’s market, since even 1% of a powerful economy is a lot of money.

Those countries missing the 30% bonus (that’s most of the rest of them) have a much more difficult challenge. The trick is of course to find a partner country which does not want the bonus itself- or rather, the prospect of 5% of the bigger countries GDP is more attractive than having 30% weapons bonus. Some countries will part with their bonus willingly, others will have to be coerced.

I expect that Chile, Iran, Russia, Spain, Portugal, Argentina, Poland will all have 100% bonuses in weapons within a short time of the changes. Romania too will likely secure the 30% bonus from Georgia, either diplomatically or by force. The remaining countries have to decide whether they are willing to pay a significant amount of money (between 5-15% of their total GDP in that industry) in exchange for resources. The below chart shows tax income vs the total cost for renting the resources required to get 100% in all three industries.

My thoughts is that whilst weapons are clearly the most important bonuses from a national income perspective, it is best for countries to pick an industry to specialise in if their native bonuses are poor. Whilst food is nowhere near as important as weapons, if you have anything below 90% weapons bonuses nobody will invest anyway, so you might as well go for a safer and cheaper option.

Political and military take-overs

Any country which is small-ish and has either the 25% or 30% bonus needs to find a partner to sell it to as soon as possible, or face the risk of military/political take over. Those resources are now incredibly valuable, worth anything from 20-125k currency per day, and even if a larger country doesn’t launch a PTO, a private group will be tempted purely to gain access to that lucrative income.

Conclusion

I hope this article has been interesting. Naturally this is all currently speculation, but the clear message is that there is a lot of foreign investment in the game, and that investment will move with the bonuses. Usually this is a slow process (hence why Poland is still such a huge economy), however with the free option given by the admins to move companies there will be a lot of rapid change. Governments with poor native bonuses will need to assure investors worldwide about their plans to acquire foreign bonuses or they risk losing company owners. This will also have an impact on tax income.

Iain

Thank you to everyone who endorsed my last article. Your support is greatly appreciated and noted!

Also thank you- 6th media mogul medal

🙂And they said it couldn't be done in this less active age...

Comments

Poimaxxxxx

Well Done

お見事!

voted

vote & cm

One of the best and most informative articles ever!

Congrats!

And, thanks!

v+e

o7

Great piece,

Shouted in my county and MU feed

It’s true that having bonus regions in core is a big advantage but there are options if you don’t have them in core. I doubt the latest change would be extremely disruptive 😁.

I am confident Ro bonuses will not be heavily impacted by the changes.

Also for 100% houses bonus? I am with Spite about that, different with food and weps that are more common resources

Interesting for irnan

Congrats!

Voted and endorsed,

I didn't see the one shot to move companies/holdings that makes me a lot more interested in how this pans out

What I need to consider next is whether the benefits of having food companies and weps companies in separate locations plus my residence out weigh the cost of daily moving tickets

They almost certainly do, depending how many companies you have of course. I just buy food since making it is basically breaking even. But I move multiple times a day between different holding companies in different regions and it's much more profitable than putting up with pollution for example.

I think I'll certainly use the free move to sort weps production, (I have 1 Q7 and enough rubber for 4workers in Q7) and then ~6000 energy in food (all WAM)

I'm thinking moving to decent european countries for weps to keep travel down, I'll probably leave food in Scotland as 70% more than covers my needs

Buy the extra WRM and run your Q7 at max. You still make a profit.

When I move I will, while I'm based in Scotland I'll make a loss with current wages and I can't justify paying to move when I know a free move is coming.

It's my own fault I haven't moved yet, I did the research last time I spoke with you and then got busy in RL before I moved everything and it didn't happen, I'll wait for these changes and then do the research again

By my calculations Q7 is not profitable for quite some time now. By producing Q7, after paying workers and WRM it is either break even or loss. If producing WRM it is more profitable to just sell it. Right now it is a _big_ loss.

Iain, you deserve an automatic V+E for every single article you publish. It honestly amazes me that you can still manager to muster the energy.

Even though the game is awful in many ways, I still enjoy the community and the fact we are all playing together and can learn from one another. The media module, if done right, is probably the best part of the game. Just a shame there's so few people active in it these days.

It's more work to write a decent article these days than it is to be CP; perhaps that's why? 🙂

Vauuu....

Nice analyze, great works!

vote

Maybe from the viewpoint of the rental contracts it would make sense to change the taxation of employee work, if noone would sign a rental contract in these industries since it has no impact on the tax income of the country. But this is only one thing and in my opinion not the most important.

The present concept of the game is that once was a resource war and now every country have to deal with the consequences of their performance in that for an infinite time. Now in two industries, house and aircraft weapons not the countries are rewarded that once acquired the bonuses and since then don't have to do anything, but the countries whose citizens are actually active in these industries and produce these products, which is less easy and less rewarding than in the WAM industries. So I am against changing this taxation rule, as it would further entrench inequalities between countries based on an event some hundreds (or thousand?) days ago.

I am sure another resource war is incoming.

How do you know? In my opinion admins would refrain from doing so, because if they redistribute the resources in the current imbalanced system the result would be a few countries collecting max bonuses multiple times, while the others getting in even worse situation. In addition if the tax will be a reward of bonuses (that would continue to be an inherited fortune later on) from my perspective that would mean I couldn't do anything in economy that would help my own country instead of a huge enemy empire. What would be left is to shut down companies and leave this part of the game (too).

In fact there have been 2 resource wars already.

The second resource war brought avio resources which were heavily fought but because of the failure to add higher quality air weps the industry is almost non existent 😁

vote

great

very good

Well done!

wow

Great as always 🙂

Small countries with valuable resources in their cores, now will have congress but no sovereignty 🙁

e.g., Georgia has rubber in Abkhazia (hence Abkhazia has been under Romanian occupation for a long time). Wonder what will happen after day 3929, when Georgia liberates Abkhazia, and Romania can't keep them occupied(high determination) for (at least) the next 200 days.

So, the only way Romania can get Georgia's rubber is thru concession. However, Georgia would rather keep it for herself or concede it to her ally,Turkey.

What can Romania do?

- make Georgia a generous, irresistible offer (highly unlikely)

- move on, find someone else willing to concede its rubber (in case some other country occupies the region(with rubber in it), Romania would have to AS asap in order to free the region and she would probably stay in one(or more) neighboring regions to protect her resources(2-3 months later, due to determination, would have to move to a different neighboring region), or engage in a TW with a country who owns some/all of the neighboring regions. It takes a lot a money and effort. Abkhazia, on the other hand, shares a border with Romania.)

- threaten, MTO Georgia. (likely?)

Completely agree. The problem is after all that admins can't cure the root illness of the game that is imbalance, just make changes that hide the symptoms. After Romania MTO-ed all countries they needed for the resources admins will have to come up with a change that makes MTO unprofitable to prevent eternal MTOs. When Romania finds new ways to make their dominance prevail at the expense of making the game unenjoyable for others, admins will have to come up with new changes to prevent these effects. Until the point when nothing can be done in the game.

Current game balance in terms of countries is purely to do with politics, not game balance. Admins aren't going to do anything about that. These changes should stir the political pot somewhat.

Well, the MPP deployment was introduced to reduce the effect of one side having 70-80% of the world damage in every MPP battles. The reason for the change in the determination rule is probably more complex, but in my opinion eternal deletions like Greece and Hungary could play a part. For USA there's maybe a political option, for these two there's no, under the present conditions they will never be liberated. Also admins already changed the dictatorship rules once to reduce the number of dictatorships when almost every country MTO-ed itself.

The reason they're deleted is political. Asteria is super strong because it has no opposition. Thus you are either pro-Asteria or you're wiped. If there was a strong opposition this wouldn't be the case and a lot of vaguely pro-Asteria countries would probably switch sides if the opportunity was right.

Most of the problem is the anti-Asteria group:

1. Won't unite because they dislike each other too much

2. Keep blaming Asteria or the game for the fact

It's easy to blame others/the game but it's just politics.

It's not that I blame anyone. If the game won't attract new people this political pot can't be stirred up. The very same people will be doing the very same things that they have been doing for years. The game mechanical framework changes, the substance doesn't.

Very good analysis my friend!

o7

Bravo!

i cant believe that you still play this 😃

I came back at the end of March and I haven't got annoyed enough to leave yet...

2click mode or active mode ?😃

I was President twice, so I guess these days that's 50/50?

well i dont have idea 😃 im 2klick mode and i dont follow that much game 😃 maybe for president possition 1 klick mode is enough 😛PPPPPPPPP

good work o7

enjoyed reading this 😃

o7

o7

NICE ANALYSE, THIS WILL MAKE THE GAME MORE INTERESTING FOR SMALL COUNTRIES THAT I THINK WILL HAVE ADVANTAGE !

o7